TOGETHER WITH  | Good day. According to a July survey by the NY Federal Reserve, respondents expect inflation through year-end to: a. slow down, b. stay the same, c. increase. Follow the wave 🌊 below for the answer. Here are our finance & investing topics for today: - Signs of price relief

- The increasingly unsustainable car market

- People are forgetting to pay bills. Here’s how to remember to pay

| |

ECONOMY Signs of Price Relief | | | | It’s been a long fight with inflation. We’ve seen record monthly CPI numbers of 5% or higher since mid 2021, and watched those numbers tick subsequently higher each month since, which is now sitting atop 9.1% YoY. Economists have been searching for signs of a peak for a while, and thought they found it on multiple occasions. So, at risk of being the boy who cried wolf, we won’t get too optimistic, but there are now a few signs of price relief that we couldn’t ignore. Inflation is still bad, but… - Fuel & energy: Oil, and therefore fuel, is mostly a global market, so when international conflicts of existential nature pop off, global markets get disrupted, and this is reflected in their price. We see this emphatically in our CPI reports from the spring, when fuel/oil jumped a lofty 22.3% in March and 16.9% in May. In June though, that number was a negative -1.2%, and average gas prices have fallen across the country in lockstep as tensions and fears seem to wane.

- Food costs: Food prices were another major victim of inflation's wrath, with almost nothing left untouched. Food’s rate of inflation has decreased slightly in recent months though, and the CPI shows this. From a 1.2% jump for food at home in May, and a 1.4% climb for food away from home this same month, both line items fell to 1% inflation in the month of June. Elsewhere, the United Nations Food and Agriculture Organization's Food Price Index has continued to decline as well, and now sits roughly 3% below the level it was at in March, which showed a 13% spike.

- Home prices: Home prices in various markets across the nation have begun to “cool” too. Much like inflation elsewhere, they haven’t gotten cheaper, but their rapid rate of increase seems to have slowed. According to mortgage software company Black Knight, year-over-year home price growth slowed precipitously in June, declining from 19.3% to 17.3% last month. Anecdotally, there are numerous examples of prominent US markets where price growth has also slowed as well. So, although this drop isn’t really indexed well by inflation, it’s a major price relief nonetheless.

What this means for us While it is nice to know that we’re finally seeing some price relief in niche areas on a macro scale, there are still many fraught variables up in the air right now that could, at any moment, add some inflationary fuel to this fire. In the meantime, we should remain prepared for elevated expenses to continue and bolster our budgets accordingly, while of course simultaneously crossing our fingers for the best. Take this related lesson on this topic and earn Dibs 🟡 while you're at it:

| | | |

MARKETS The Increasingly Unsustainable Car Market | | | | It’s safe to say that an absolutely weird car market has been one of the most unforeseen side effects of the pandemic, and something we’re still dealing with today. Things have gotten bad, and it’s probably worse than you think. So, let’s look at some data to sort out just how truly scary it might get. The cost of gettin’ around - You get a loan, you get a loan, and you get a loan: The most recent US data puts America's auto loan debt at a grand total of $1.4 trillion dollars, making up approximately 9.4% of all consumer debt. That’s an increase of about $78 billion between 2020 and 2021—a figure that easily lapses the $44 billion we added the year prior. The average auto loan balance surpassed $20K for the first time ever, while the average loan amount for new vehicles increased by 8.8% to $37,746, and financed used cars jumped a heaping 20% to $26,230.

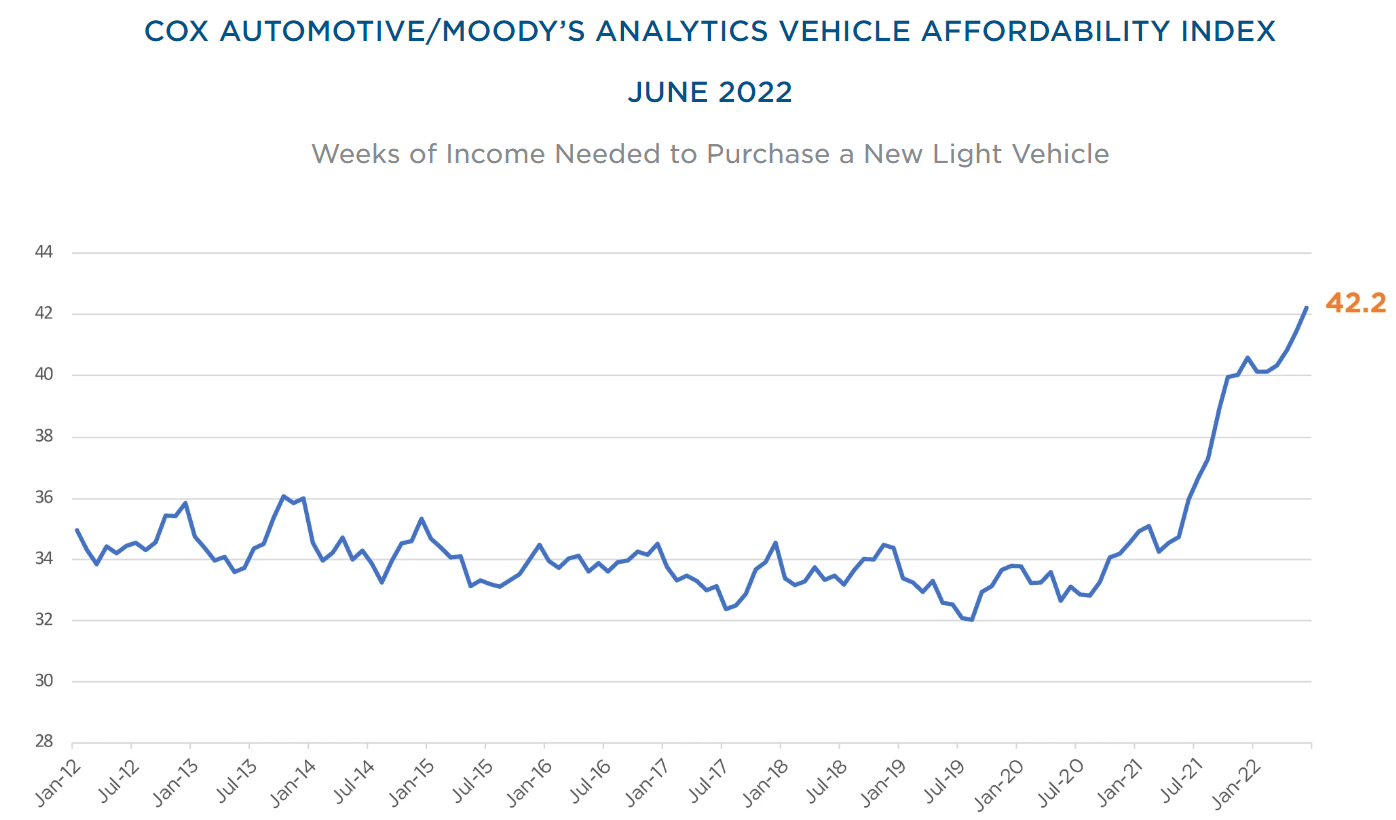

- Affordability: We knew cars were getting expensive, but no one anticipated we’d be needing mortgages for them. Per the Cox Automotive/Moody’s Analytics Vehicle Affordability Index, the average car buyer in the US would now require about 42.2 weeks of unbothered income to purchase a new vehicle outright. Before 2021, this number traditionally hovered around 35. With about 82% of new cars selling for over MSRP now compared to just 2.8% last January, it’s no wonder prospective buyers are being priced out.

Source: Cox Automotive

- The fallout: If this reminds you a little bit of the 2008 housing crisis, you might be onto something. As prices have gone up drastically, lenders have to compensate for this—auto lenders have gone from traditionally lending up to 80-90% loan-to-value (LTV) to now up to 140-150% on both new and used vehicles. These higher LTV ratios have been found to be associated with a higher charge-off rate too, per Experian. Ramifications of this are being seen across the industry, as the number of auto loans 30 days past due (DPD) has skyrocketed in recent months, with Washington D.C. being the worst among US states with 23.4% of auto loans 30+ DPD.

Steps to take in response - Assess the purpose and need: Many consumers who think they’re in need of a new car actually just mean they really want a new car, and have convinced themselves it’s a need. And there are, of course, instances where it's a legitimate need, whether it's for work, family, etc. But before you make that decision, it pays dividends to take the time and do some situation analysis to weigh the pros and cons of the purchase, and whether or not you can find a suitable vehicle without it being a financial burden.

- Steer clear of lifestyle inflation: One of the first things newly high earners are tempted by is usually cars, right? Of course, they can be a lifestyle symbol and a seeming necessity. Despite this, falling into the trap of justifying a purchase just because we can afford the payment is rarely a good idea. Not only is income rarely a certitude, but devoting those funds to something like a car is hardly ever a good investment unless you’re wealthy enough for it not to make a dent.

- Re-evaluate car purchases: If you go on the Toyota website and spec yourself out a fairly basic Camry, you’re set to pay about $32,000 MSRP, and that’s before the market kicks in and you pay over that price plus dealer fees. At a certain point though, it’s time to ask yourself, “why am I taking out a loan or paying $30K+ for a basic new car?” Does a new simplistic sedan really add that much value to my life, or would a 2013 do the same thing for $20K less?

Take this related lesson on this topic and earn Dibs 🟡 while you're at it:

| | | |

TOGETHER WITH FINMASTERS Stock Wars: Compare Investments in Stocks & Funds | | | | Have you ever wondered how much a $100 investment in Intel 20 years ago would net you out today? And how much more you would've had today had you picked the Apple stock instead? That’s where Finmasters’ Stock Wars tool comes in really handy. Here you’ll find out that a $100 investment in Apple 20 years ago would net you out roughly $75K more today than the same investment in Intel. You can use the Stock Wars tool to compare stock or fund performances over time and start thinking about your next bet. Check out Stock Wars by Finmasters. It’s fun, educational, and totally free. | | | |

MONEY TIPS People Are Forgetting To Pay Bills. Tips To Remember To Pay |  | | Giphy—Amazon Freevee | | | Multitasking is pretty hard to do effectively because we make an average of 35,000 choices a day. With so much going on in life, it’s far too easy to underestimate just how much focus and consistency it takes to be an adult and maintain your life. That’s why it’s easy to understand why some of us might forget to do some things here and there, and that includes the important stuff too, like paying bills. JPMorgan Chase, for example, reports that throughout the first 6 months of the year, 1.05% of its credit cardholders were 30+ days delinquent, up from last year. Elsewhere, auto loans are also up to a 0.69% delinquency rate compared to just 0.42% in 2021. Creating sustainable ways to remember your bills - Create a trigger: For better or for worse, certain things remind us of other things, that’s why nostalgia exists. But see, when it comes to bills, we can use this as a memory trigger to remember to pay our dues on time. Aside from creating the obvious reminder on your phone, you can begin to mentally associate your expenses with certain things. For example, if your mortgage is due on the 6th, and the day of your birthday falls on the 6th, remembering that can help remind you of the other.

- Set up auto bill pay: If you’ve missed a bill or two so far this year, set up automatic bill pay. This is probably the simplest way to avoid forgetting to pay the bills. Setting up bill payments to be automatically deducted from your checking account the day you get paid is, for example, one of many ways to crack the nut.

- Schedule time to review your bills: Perhaps the best way to go about being on time is to be proactive or intentional about your money—where it goes and how you manage it, whether you automate paying your bills or not. Set aside time regularly to check on your account, like keeping a journal or excel sheet of when all your bills are due and checking your statements to make sure your bills are accurate in the first place.

- Break your tasks down: If you wanted to lose 40 pounds, it would be pretty defeating to look at it that way. On the other hand, 5 seems a lot more manageable, and it’s an easier goal to get motivated for. The same applies to big financial tasks that seem insurmountable at first, like saving for a home, or tackling a mountain of debt. Break down your goals into sections, each with its own actionable steps.

Take this related lesson on this topic and earn Dibs 🟡 while you're at it:

| | | |

🔥 TODAY'S MOVERS & SHAKERS | - CarGurus (-22.7%) and Vroom (-35.6%), both online used car sellers, reported lower than expected quarterly earnings. Carvana (-12%), another used car seller is also down as a result.

- Novavax (-28.8%), a drug maker, posted an unexpected quarterly loss, while slashing full-year revenue guidance by 50%; it also doesn’t expect further sales of its Covid vaccine as there is too much supply and little demand.

- Occidental Petroleum (+3.9%) on the news that Berkshire Hathaway increased its stake in the company to more than 20%; that means, Berkshire can now record part of Occidental’s profits as its own.

- Bitcoin (-2.9%) to $23,101.80 (1D)

- Ethereum (-4.7%) to $1,690.93 (1D)

This commentary is as of 8:30 am PDT. | | | |

🌊 BY THE WAY | - 👜 Answer: slow down, and by a lot. A New York Fed survey showed that respondents in July expected inflation to run at a 6.2% pace over the next year and a 3.2% rate for the next three years (CNBC)

- 📱 Do your phone a favor and clear your cache (CNET)

- 📉 ICYMI. What is stagflation? (Finny)

- 🥗 Food expiration dates don't have much science behind them (The Conversation)

- 🏀 Can sports cards be the store of value during tough economic times? (MoneyMade)

- 💰 Finny lesson of the day. Are you finding yourself saving less these days? Here's a quick rule of thumb to help you save more (and earn Dibs that you can redeem for rewards while you're at it!):

| | | |

What did you think of Finny's The Gist today? (Click to vote) | | | |

| Finny is a financial education platform on a mission to make your money work for you. We offer a customized financial learning platform through bite-size, jargon-free lessons, money trends & insights. The Gist is Finny's twice-a-week (Tues & Thurs) newsletter covering personal finance & investing insights and money trends. Finny does not offer investment and stock advice or endorsements. The Gist content team: Chihee Kim, Austin Payne, Carla Olson. We're thankful for the support of today's sponsor & partner—Finmasters, Tally—as they make rewards on our platform possible. If you're interested in sponsoring The Gist, please reach out to us. And if you have any feedback for us, please contact us. | | | | | | | |

No comments:

Post a Comment