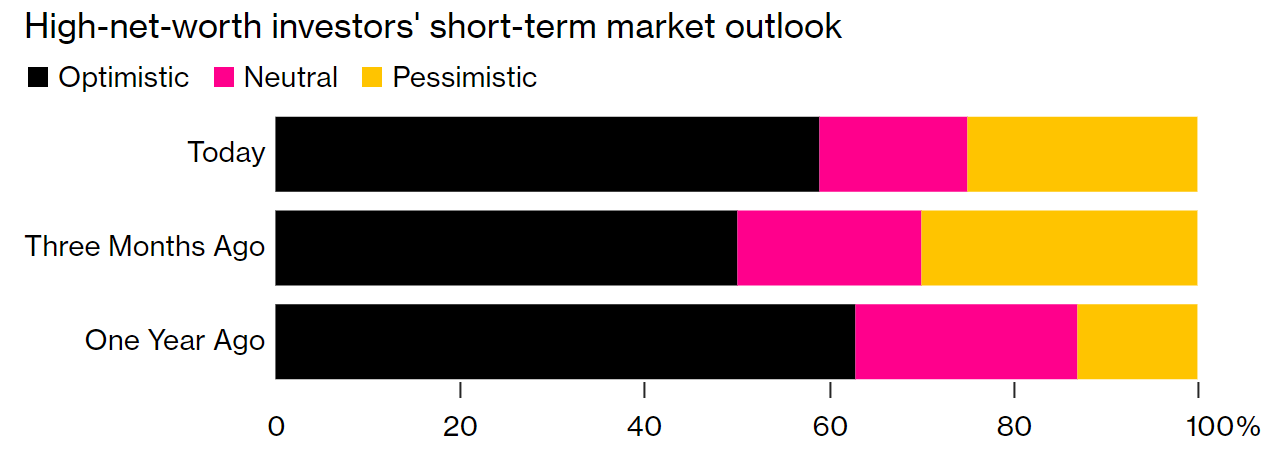

TOGETHER WITH  | Good day! There's a looming recession in the US, the Feds continue to fight inflation as they hike rates by another 0.75%, war rages on and a new Covid variant is rearing its head just in time for the cold season. The list goes on and on. Given that, can you guess what percent of rich investors are optimistic about the short-term outlook for the stock market? a. 49%, b. 59%, c. 69%. Follow the wave 🌊 below for the answer. Here are the money & investing topics today: - Mixed signals

- Investors are lining up for the quirky ETFs

- Refinancing your student loans: pros & cons

| |

ECONOMY Mixed Signals | | | | 2022 has been a year of mixed signals when it comes to the economy. High inflation, yet resilient spending. Rising rates, but low unemployment. A down market, and still record earnings for many businesses. So naturally, just as many economists begin calling for a certain recession in 2023, we've been handed yet another conflicting indicator — a sizable beat on our Q3 GDP projections. Taking a look under the hood - The GDP numbers: After decreasing by -2.2% through the first two quarters of the year, US GDP bounced back by 2.6% in Q3 alone, surpassing most projections and putting us at a slight gain on the year. However, inside that number were signs of a slowdown in areas like consumer spending, business spending, and residential investment — meanwhile, net exports were the leading driver.

- Economic counterparts: Inflation remains high, but we did see some alleviation as sub-categories of inflation like the chain-weighted price index rose only 4.1% —below its projected 5.3%. But it's not all positive. Home sales continue to decline as mortgage rates top 7%, many private measures of economic activity also fell, and we're expecting to lose 175,000 jobs per month in Q1 of 2023 as 98% of CEOs brace for a recession.

- The collective picture: With most of the recent quarter's GDP growth coming from temporarily boosted exports, slowing consumer spending combined with high inflation and equally high rates will likely weigh on the coming quarters' GDP metrics.

The takeaway? These conflicting numbers and observations only leave us with one certain observation — uncertainty. It's always hard to predict the future, but this environment is proving exceptionally challenging to forecast. Expect the best and prepare for the worst. Shoring up our financials, skills, and knowledge as much as possible is our best defense against more pain that may come, and an invaluable chance for personal progress no matter the outcome. Take this related lesson on this topic and earn Dibs 🟡 while you're at it: | | | |

INVESTING Investors Are Lining up for The Quirky ETFs | | | | Exchange-traded funds (ETFs) are one of the market's simplest packages to choose from. With their ability to track a basket of assets without buying individual stocks and their low-cost nature, ETFs are the investor's sweetheart and are found in almost any portfolio. But even these simply packaged investments have some tricks up their sleeve, and their usual bland safety can quickly be turned into tempting volatility with a few modifications. The dominance of ETFs continues - Leading the pack: ETFs have skyrocketed in popularity lately. After a significant boost of $1.6T and hundreds of new funds in 2021 alone, there are now over 8,000 funds available globally holding more than $7.1T in assets while accounting for around 20% of market volume on any given day. Needless to say, these guys are popular.

- New flavors allure: In 2022, inverse and leveraged ETFs have established themselves as a strong subcategory of this group as investors dumped over $25B into these risk-on funds, representing 6.1% of all ETF fund flows this year and far beyond the previous record of $17B set back in 2008.

- Inverse & leveraged 101: As you might infer, inverse ETFs are curated to capitalize on losses. For example, if the S&P 500 Index drops, the inverse ETF tracking the index rises. The mechanics behind this are complex but are accomplished usually using various derivatives (i.e., swaps, futures, and options contracts). Leveraged ETFs work much the same and are used to amplify the returns of the underlying index.

- What we need to know: These funds are inherently contrary to the motion of the market in long-term time frames. They're designed for traders, speculators, large account managers, and anyone seeking a temporary hedge or opportunistic profit chance. They're meant to be held for a short period, and holding a fund like this for any length of time is risky.

They're not going away The rise in popularity of these colorful funds can partially be attributed to the increased interest in active trading we've seen in recent years that's still trickling in, but also an ongoing bear market that's ripe with opportunities presented by heightened volatility. Despite a down market, fund curators aren't going to lose their creative zeal overnight, nor are investors losing their appetite for more unique options like these inverse and leveraged varieties. Expect to see more and more eccentric choices arriving in the coming years, even if they're red ones. Take this related lesson on this topic and earn Dibs 🟡 while you're at it: | | | |

FEATURING EQUI | | | | When it comes to investing, the past few years have been dizzying. Inflation, tech booms, tech busts, skyrocketing borrowing costs, COVID – you name it, and our portfolios have lived through it all (and sometimes just barely). And that volatility is all the more reason to try something new: Liquid alternative strategies. - Equi makes it possible to access alts by using sophisticated data science and robust manager due diligence to compile a diversified portfolio of niche liquid alternative investments.

- Their risk management constantly monitors and rebalances the underlying strategies and applies hedges to help protect against downside risk.

- The result? Equi is designed to compound capital through various market cycles, including during the highly volatile periods we're experiencing now – evidenced by Equi's outperformance of the S&P 500 since inception.

There is a waitlist though, and The Gist by Finny readers will get a first look. *See disclosure below | | | |

MANAGING STUDENT DEBT Refinancing Your Student Loans: Pros & Cons | | | | Spread amongst about 48 million borrowers, Americans are collectively indebted more than $1.75 trillion (about $1.25T after forgiveness) to student loan lenders across the country, and about 94% (45.4M) of those borrowers owe federal student debt. Even in light of the pending forgiveness plan, millions of Americans will still be sitting under mountains of student loan debt after the fact. These payments are hard to make for many, and the accruing interest can eat you alive in the process. If you find yourself in a situation like this, it might be time to beg the question — is it worth refinancing? What to know about refinancing - The basics: For most Americans who are federal borrowers, you can't refinance a federal loan — doing so would require refinancing with a private lender, thus changing your loan type. Whether or not this is worth it depends on the details of your federal loans. As for those with private loans, refinancing is a more straightforward process.

- The pros: The pros of refinancing your student loans are mostly convenience-oriented. Doing so allows you to change your repayment period to something that works best for you, group your loans into one simple package, lower your monthly payments, or even do so with a co-signer.

- The cons: The cons here can be detrimental if not considered carefully. For one, refinancing your federal student loans at the wrong time could mean missing out on the forgiveness plan, or giving up considerations like the income-driven repayment option. For both private and federal borrowers, refinancing could also result in a higher rate, lengthen your repayment timeline and weigh down your credit, or you may not be eligible at all.

Take this related lesson on this topic and earn Dibs 🟡 while you're at it: | | | |

🔥 TODAY'S MOVERS & SHAKERS | - Etsy (+13.7%) as the online crafts marketplace reported better-than-expected quarterly earnings.

- Lincoln National Corp (-31.9%) as the financial services company reported a $2.6 billion quarterly loss amid reserve and goodwill impairment charges.

- S&P 500 Index (-0.4%) to $3,742.81 (1D)

- Bitcoin (+0.6%) to $20,264.80 (1D)

- Ethereum (+1.7%) to $1,544.30 (1D)

This commentary is as of 10:20 am PDT. | | | |

🌊 BY THE WAY | - 🌞 Answer: 59% of rich investors told UBS Group AG they are optimistic about the short-term outlook for the stock market. They cite strong demand for goods and services, a return to normalcy post the Covid-19 pandemic and healthy corporate earnings (Bloomberg)

- 🐔 Chick-fil-A's four-day weekend experiment for workers (NY Post)

- 🪤 ICYMI. BOGO & the retail trap (Finny)

- 💡 Current administration to provide over $13 billion in aid to help American families lower energy bills (CNBC)

- ⚕️ Finny lesson of the day. Since many companies are going through their benefits open enrollment now or very soon, here's a lesson related to helping you decode a work benefit:

| | | |

| |

| Disclosure Equilibrium Ventures, LLC is registered as an investment adviser with the Texas Securities Board Investment Advisers Act of 1940. Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the entity by the Securities Exchange Commission. The information provided should not be construed as investment, legal, tax, or trading advice and they are not meant to be a solicitation or recommendation to buy, sell, or hold any securities including funds mentioned. Any such offer or solicitation can only be made by means of the delivery of a Confidential Private Placement Memorandum to qualified eligible investors. Past performance is not indicative of future results and an investment in an investment fund involves the risk of loss. The investment fund is speculative and involves a high degree of risk. Before investing in the fund, you should thoroughly review the offering documents with your legal, tax and investment advisors to determine whether an investment is suitable for you in light of your investment objectives and financial situation. References to S&P 500 are included for illustrative purposes only. It is not expected that funds will make investments in S&P 500 companies. Funds are expected to invest with a strategy that is different from a strategy of making equity investments across an index. Accordingly, investors should not expect that an investment would provide exposure that is similar to an index investment in S&P 500 companies or any other specific benchmark. About Finny Finny is a financial wellness platform on a mission to make your money work for you. The Gist is Finny's twice-a-week (Tues & Thurs) newsletter covering personal finance & investing insights and money trends. The content team: Austin Payne, Carla Olson, Chihee Kim. Finny does not offer investment and stock advice. Please support our brand sponsor—Equi—as they make rewards on our platform possible. If you're interested in sponsoring The Gist, please reach out to us. And if you have any feedback for us, please contact us. | | | | | | | |

No comments:

Post a Comment