TOGETHER WITH  | Good Tuesday. According to a recent survey, can you guess what percent of the global adult population thinks it's likely that major stock market indexes around the world will crash in 2023? a. 30%, b. 40%, c. 50%. Follow the wave 🌊 below for the answer. Our finance topics for today: - Investor Emotions Are Worn Out

- How To Manage a Windfall

- Credit Card Mistakes to Avoid

| |

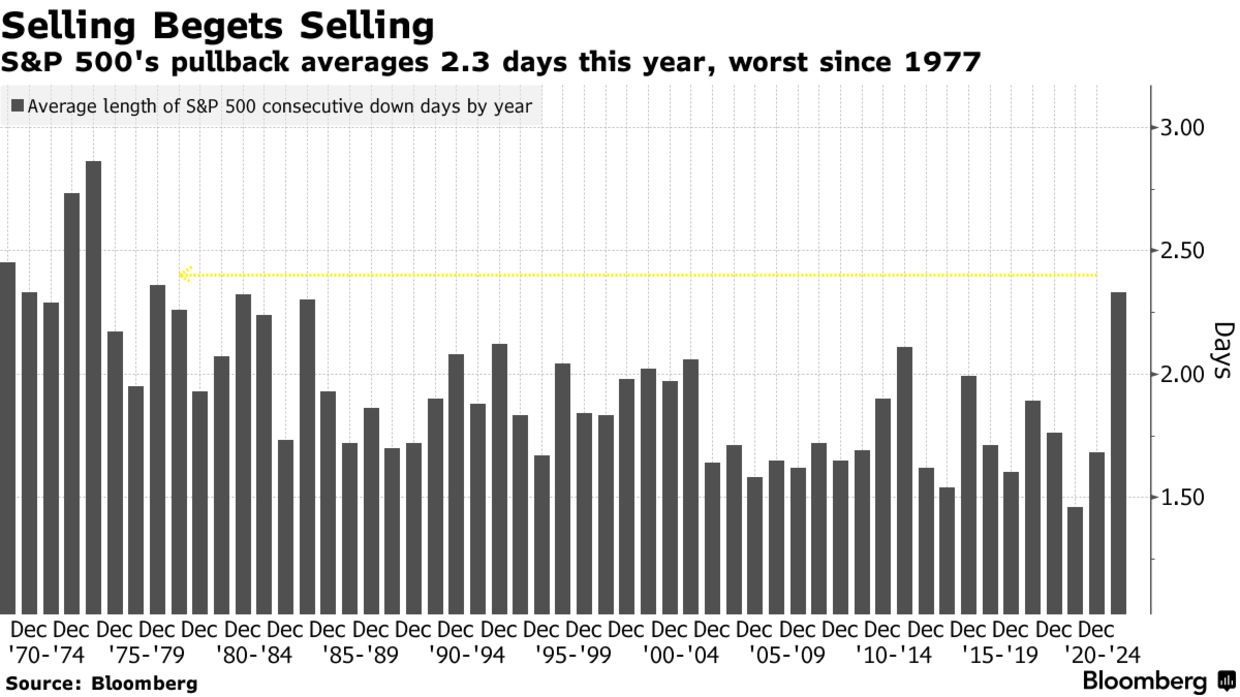

MARKET OUTLOOK Investor Emotions Are Worn Out | | | | The public markets are only consistent in one way — the long-term trajectory. When it comes to the day-to-day affairs of investing, the stock market is anything but consistent and predictable. Markets are prone to irritability and erratic movement, susceptible to any and every catalyst that's given enough weight. Over the last few years, fear and uncertainty have brought out the worst of the market's inherently volatile nature. This new reality is bleeding into the psychology of investors, forcing us to change our ways, and sometimes not for the better. Source of the trauma - Worse: The S&P 500 had its 7th worst year ever in 2022, but the nature of the fall made it seem worse. The index endured an average decline of 2.3 days at a time, the worst seen since 1977, leaving investors feeling winded.

- Fake outs: The index rebounded by 10% or more on three separate occasions last year, giving investors plenty of chances to feel a false sense of hope. Between the elongated declines and valiant rallies, emotions are simply worn out.

- Wear & tear: Over the last three months, investors sold over $100B in stocks, unraveling 15% of their amassed holdings in recent years. We may be beyond peak fear, but the traumatic times have taken their toll.

- Unresolved: Much of the chaotic catalysts that created a volatile year remain unresolved, meaning the conditions for choppiness are still here. In just a couple of weeks of trading, the markets have trended upward in unison heading into 2023, but a barrage of catalysts still weighs on the horizon.

Looking for recovery The idea of "regressing to the mean" is a popular statistical observation that can soothe a lot of fear. While it is true that over time horizons markets tend to return to their usual form, it's not always a straightforward transition. For now, it'll take some time for this chop to subside, and investors will have to adapt, overcome, and ride it out. Take this related lesson on this topic and earn Dibs 🟡 while you're at it: | | | |

FINANCIAL PLANNING How to Manage a Windfall | | | | Happening upon a windfall is a rare occurrence in life, yet something many of us may encounter once in our lifetime. Coming into a surprise lump sum of cash might seem like a dream, but the saying "more money, more problems" also rings true. So, what are a few essentials to get in order to manage a windfall? The essentials - Taxes first: The Mega Millions drawing of $1.35B last Friday had a net payout of less than half of this amount. This is an extreme example, but it goes to show that lump sums of cash are rarely what they seem. Whether your windfall comes from the lottery, an inheritance, or elsewhere, the reality is that most often you'll owe taxes on that gain — and taxes always need to be taken into account before making any money plans.

- Consider liabilities: Before delving into what you'd like to do with the money, consider what you have to do with it sooner or later. If you've come into a windfall while simultaneously having outstanding high-interest debts, now would be the time to consider eliminating those before doing anything else.

- Next, your goals: Once you've checked those boxes, making room for your personal goals is the next order of business. After you've saved up an emergency fund and your retirement savings are on track, set aside a portion of the leftover cash to help fund personal goals important to you.

- Don't forget legacy planning: Depending on what stage of life you're in, establishing a solid legacy/estate plan for the future of your family would be an important last move to make. Whether it's transferring assets, acquiring more, or even just setting up a will or trust, incorporating your wishes and legacy is always a good investment.

- It's personal: There are tens of different moves you could make in the wake of a windfall. Maybe it allows you to catch up on investing for retirement, bolster your savings, update your home, start a business, or even get your feet wet with charitable contributions. Ultimately, the best way to manage the money depends on you and your situation, but keeping the essentials in mind will ensure that circumstances of any sort can be navigated responsibly.

Take this related lesson on this topic and earn Dibs 🟡 while you're at it: | | | |

TOGETHER WITH FINMASTERS An Illustrative Guide to How Inflation Works | | | | Inflation is our new reality. Prices are climbing beyond control and diminishing your purchase power, but do you really know how inflation works? That's where this illustrative guide from FinMasters comes in handy. Here you'll learn about what causes inflation, how it's measured, and how to even benefit from it. You can use their calculator to find out how much a car, a movie ticket, or a cup of coffee cost 20 or 50 years ago. Check out FinMaster's educational, free guide on How Inflation Works today. | | | |

MANAGING DEBT Credit Card Mistakes to Avoid | | | | Credit cards are a double-edged sword that can serve as either a positive or negative boost to your finances depending on how they're handled. Mismanagement can be detrimental, but with the right discernment and planning, they're a great asset to have in your arsenal. There are some key components to capitalize on in order to do this successfully, and many of them are often not considered enough. - Not maximizing: Don't wear a dress to go hiking, and don't use a cashback card for travel. It's important to use your card for what it's built for to max out the benefits you're able to reap from it. If your everyday card has 3% back on groceries but only 1% on travel, use a card that better rewards you for your travel expenses. This same idea can be applied to numerous scenarios, but the overarching point is to let your card do its best work.

- Opening the wrong card: Don't go for an everyday cash-back card for specialized expenses, and don't get an Amex Platinum just to shop online sometimes. It's alright to open "just any" credit card when you're first starting out, but your palate should become more sophisticated as your credit matures. Apply for new cards rarely and only when their best uses suit your use cases too.

- Don't mess up the basics: Make the plain things the main things, because it's easy to have an oversight on the mundane, and they're boring for a reason. Prioritize paying your card off in full every month, maximizing your cashback, and documenting all expenses you use your credit cards for. These simplistic things alone will avoid trouble if done regularly.

- Not negotiating: Most credit cards don't charge an annual fee, but if you hold one of the 30% of cards that do and find that you're getting value out of it, you could be getting even more by negotiating that fee down. Yes, although it's not advertised, it's almost always possible to ask for a lower annual fee if done with the right manners and for the right reason.

Take this related lesson on this topic and earn Dibs 🟡 while you're at it: | | | |

FEATURING THEFUTUREPARTY The Future Isn't a Mystery | | | | Across every cycle, there are several culture trends that define the zeitgeist and shape the environment. More often than not, these emerging phenomena have massive economic implications. That is why you need to stay sharp on what's happening at the bleeding edge. Thankfully, our friends at TheFutureParty help you do just that. Their daily newsletter curates stories spanning entertainment, business, and culture, and breaks down what it all means for the future. Join 190,000+ driven professionals and don't miss out on concise hot takes that are relevant and fun to read. Subscribe for free. | | | |

🌊 BY THE WAY | - 🌎 Answer: 50%. Most survey respondents from around the world felt that the likelihood of global stock markets crashing was more likely than unlikely. The only three countries where citizens believed a 2023 stock market crash was less likely were China, Israel, and Hungary (Visual Capitalist)

- 🔮 The Simpsons are great at predicting the future (Insider)

- 🧹 ICYMI. Clean up your online spending (Finny)

- 🍝 Food fraud secretly infiltrates kitchens across the U.S. — here's how to avoid it (CNBC)

- 🎚️ Finny lesson of the day. If the theme a "new year, new you" resonates, it's worth revisiting your risk tolerance. It has implications across many of your money-related decisions:

| | | |

| |

| Finny is a financial wellness platform for employees. The Gist is Finny's twice-a-week (Tues & Thurs) newsletter covering personal finance, market trends and investing insights. The content team: Austin Payne, Carla Olson, Chihee Kim. Finny does not offer investment and stock advice. Please support our brand sponsor—FinMasters—as they make rewards on our platform possible. If you're is interested in sponsoring The Gist, please reach out to us. And if you have any feedback about this edition or anything else, please email us. | | | | | | | |

No comments:

Post a Comment