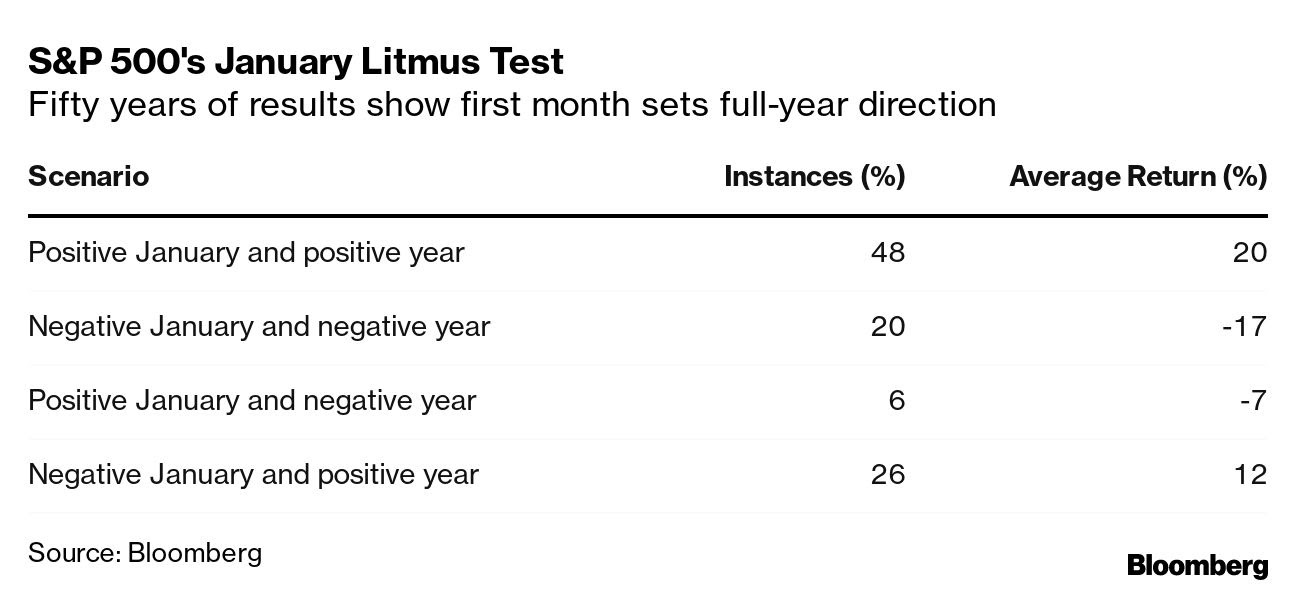

| After 21 months of market euphoria, 2022 swiftly suffocated our bonfire and brought a harsh reality check to investors. It was a year filled with inflation, conflict, uncertainty, and subsequently, a very red market. 2022 had us asking "when will it end?" and thus far, 2023 has answered that question. The year's kind start - January effect: It's well known that getting off to a good start lends itself to finishing well too. In fact, according to Bloomberg's outcome analysis looking back over the last 50 years, a green January and a green year overall is the most likely outcome out of all scenarios at 48%, with an average return of 20%.

- The year so far: The S&P 500's total return for 2022 was -19.4% while the Nasdaq dropped a whopping -33%. These two indexes were down -5.8% and -8.8% in December alone, yet they've quickly rallied 6.2% and 10.7% in January. Year-to-date and as of yesterday's market close, the S&P 500 has already advanced 7.7% alongside the Nasdaq at 15%, and the Dow Jones at 2.5%.

- Behind the move: As is with most market sentiment catalysts, the boost behind the move is vague but also understandable. Continuously lowering inflation numbers combined with news of the Fed lifting off the rate hikes a bit has given the markets a new sense of hope, and although this euphoria won't last forever, it's a nice start.

Going forward Heading into the year, most analysts project somewhere between moderate growth and a mundane year, but we know these are nothing more than guesstimates. It's entirely impossible to say what the rest of the year may hold, and a lot of it depends on how investors weigh the economic data coming down the pipeline on any given day. Markets must still navigate things like waning inflation, rates trickling north, costly debt, conflicting job reports, layoffs, and more. Thus far though, they're doing a good job. Take this related lesson on this topic and earn Dibs 🟡 while you're at it: |

No comments:

Post a Comment