TOGETHER WITH  | Good day. Despite lingering economic uncertainties causing travelers to be more budget-conscious, travel insurance company Squaremouth is calling for bigger trips to more adventurous international destinations in 2023. Can you guess which of the following international destinations are in the top 10 for US travelers in 2023? a. Antarctica, b. Portugal, c. Croatia. Follow the wave 🌊 below for the answer. The money topics for today are: - The money supply shrinks

- How life expectancy impacts retirement planning

- Tips to save money on travel

| |

ECONOMY The Money Supply Shrinks | | | | Over the last few years, we've grown accustomed to hearing about how much the money supply has expanded since our pandemic stimulus spree. Recently though, that trend has reversed. In the wake of the Fed's rate-rising rampage, the supply of dollars in our economy has finally begun to tumble for the first time. What's happening? - First, some basics: The Fed tracks two types of money supply: M1 and M2. Think of the Ms as a layering system where the lowest number is the money that's most readily available to be spent. M1 includes an estimate of cash and checking account deposits only, whereas M2 accounts for cash, checkings, savings, and other deposits that can be easily converted into cash, like certificates of deposit (CDs).

- To recap: Since March 2020, the M2 money supply in the U.S. has increased by roughly 37%. How did this happen? By way of expansionary monetary policy where new dollars were created. Near zero rates meant banks made more loans, and because of fractional reserve banking where a fraction of bank deposits are required to be available for withdrawal, loans created money. Elsewhere, the government was buying bonds and mortgage-backed securities and also pumping money into the economy via stimulus.

- And now? The supply of M2 has been declining as consumers borrow less, spend less, and the Fed reduces its balance sheet, which is already down 5.8% over the last year. For December, the M2 growth rate was down 1.3% versus a year ago, the first drop ever since M2 has been tracked.

The big picture A "tightening" money supply has potentially negative ramifications for the U.S. economy and its growth prospects, but positive impacts on inflation and its fallout. We've already seen this as CPI numbers have fallen for their 6th straight month, looking poised to continue that trend. Although a shrinking money supply isn't a sustainable forecast for the long run, there's no doubt that it's a helpful correction. We shouldn't expect this slump to continue forever, but for 2023 it could be a blessing needed to tame inflation. | | | |

FINANCIAL PLANNING How Life Expectancy Impacts Retirement Plans | | | | "Live long and prosper" as the saying goes, but it leaves out the fact that money is required for that second part. The average life expectancy in the US has been declining in recent years and now sits around 77 years, but we know this to be a highly deceptive number because of just how different everyone's health situation is. The reality is that no one knows how long they'll need to live on their retirement savings, but we do know that underestimating it can be bad. What to know about life expectancy & retirement planning - Longevity literacy: Financial literacy tests are commonplace amongst personal finance data collection surveys, but longevity literacy is something not often tested. Longevity literacy, on the other hand, is having an understanding of how long people tend to live in retirement. Recently though, a flip seems to have occurred. According to a recent TIAA Institute & GWU study, although men usually outpace women on financial literacy, 43% of women demonstrated strong "longevity literacy" while only 32% of men did.

- The numbers: The average retirement age in the US is 65 for men and 62 for women. According to the Social Security Administration, a 65-year-old retiree can expect to live anywhere from 19 to 21.5 more years after retiring, meaning we should plan for at least 20 years. The bad news? Average retirement savings for those 65 and older comes in at just about $216,000 — a figure that may not last those 20 years.

- Catching up: If you find yourself low on funds and time, don't forget about catch-up contributions. Starting at age 50, U.S. retirement savers are allowed to contribute up to an additional $7,500 to their retirement accounts by way of "catch-up contributions" to help older workers prepare for retirement.

- Aim high: Better too early than too late, and better to be a dollar long than a dollar short. When it comes to retirement planning, it's safest to assume the best — that you'll live a longer time than most. By saving and investing in a way that assumes a long retirement (i.e., 30+ years), you significantly reduce the likelihood of running out of income at any point. Worst case scenario? There's leftover.

Take this related lesson on this topic and earn Dibs 🟡 while you're at it: | | | |

FEATURING FINMASTERS Understanding The Power of Compounding Interest | | | | One of the best things you can do in investing is to invest consistently—put some money into the stock market every day or every month. Many have struggled to understand this concept, so that's why the team at FinMasters came up with an illustrative calculator called a Dollar-a-Day. This calculator allows you to visualize the return you'd be generating had you consistently invested a dollar each day since your birth date. Dollar-a-Day illustrates the power of compounding interest—a key rule in investing. Some people call it math magic. You can use this calculator to show your family and friends that investing a small chunk of money every day can help you build fortune over time. In fact, that's how many people get rich. Check out Dollar-a-Day by FinMasters. It's fun, educational, and free. | | | |

MONEY TIP Tips To Save Money on Travel | | | | There are tons of supposed travel hacks out there claiming various ways to save money on travel expenses, heck, there are even entire websites dedicated to this. It's easier to tell people they can save money than the opposite, but there's also something to be said for saving your time and energy by not chasing down a hack that may not even work, as many of them don't. Top 3 travel hack myths - Tuesday flights: There's a well-known myth in the world of jet-setting that booking mid-week, like at 12am on Tuesday, is the cheapest time of the week to book a flight. But it's wrong. Over the last 5 years, tickets booked on Tue/Wed/Thurs have only been an average of 1.9% cheaper than those booked on the weekends.

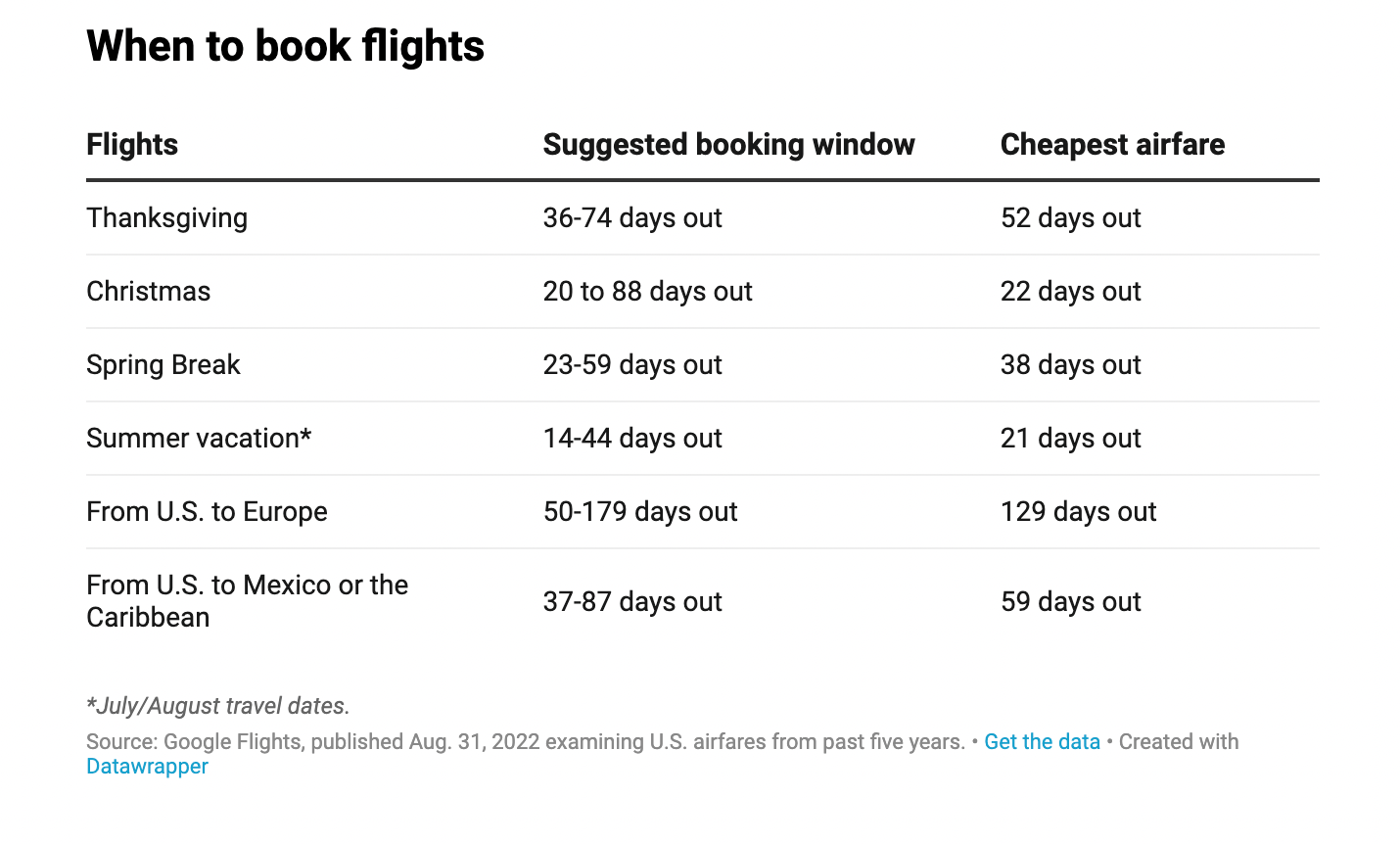

- Booking far in advance: Common sense might suggest that surely the further in advance you book a flight, the cheaper it should be as prices rise for last-minute bookings. It somewhat makes sense, but it's not accurate, and you might actually end up paying more ($50 on average) if you book too far ahead instead of during the prime booking window of 4 months to 3 weeks before.

- Dynamic currency conversion: A dynamic currency conversion is an option offered by most credit cards that allows you to pay in the country's local currency rather than your origin country's. Sounds intuitive, but it often comes with a fee of up to 8% and maybe a bad exchange rate too.

Take this related lesson on this topic and earn Dibs 🟡 while you're at it:

| | | |

🌊 BY THE WAY | - 🐧 Answer: Antartica is a 2023 top destination for the first time ever. Other top destinations in 2023 include Israel, Costa Rica, France, Spain, Mexico and Japan (Travel Agent Central)

- 🤖 Google announces ChatGPT rival Bard, with wider availability in 'coming weeks' (Verge)

- 🛬 ICYMI. Can we pull off a soft landing? Wait, what does that even mean? (Finny)

- 📺 How end of Netflix password sharing will change the way families watch (CNBC)

- 📆 Finny lesson of the day. Life expectancy & retirement or financial planning warrants a review of:

| | | |

| |

| Finny is a financial wellness platform for employees. The Gist is Finny's twice-a-week (Tues & Thurs) newsletter covering personal finance, market trends and investing insights. The content team: Austin Payne, Carla Olson. Finny does not offer investment and stock advice. Please support our corporate sponsor—FinMasters—as they make rewards on our platform possible. If you're is interested in sponsoring The Gist, please reach out to us. And if you have any feedback about this edition or anything else, please email us. | | | | | | | |

No comments:

Post a Comment