Good day. The U.S. has been enduring recession fears for well over a year now and to no avail. Despite avoiding one so far, recessions are fairly common. Can you guess what the longest one ever in the U.S. was? a. 40 months, b. 53 months, c. 65 months. Follow the wave 🌊 below for the answer. Here are the topics for today: - Even as Inflation Subsides, High Prices Remain

- What About That Recession?

- Crypto's Recent Lawsuits

| |

ECONOMY Even as Inflation Subsides, High Prices Remain | | | | Inflation has infiltrated the everyday vocabularies of billions across the globe as world economies were whiplashed in the wake of the pandemic. We're only now starting to see some light at the end of this long tunnel. According to the numbers, inflation has been receding since reaching its 9.1% peak almost one year ago, but… it doesn't exactly feel that way for consumers. Price stickiness explained - Inflation recap: Inflation began to tick up in 2021 amidst the pandemic stimulus, and formally surged in 2022 as it topped over 9% by Q3. At the same time, the Fed was anticipating this and loaded its rate hikes accordingly, throwing down 7 in 2022 alone — bringing the funds rate from 0% to 4.5% and dousing inflation's flames.

- How it's calculated: What we colloquially agree on as "inflation" is actually the Consumer Price Index (CPI), the BLS's basket of complex computations that arrive at the number we see in the headlines. The thing is though, the number we see each month is only relative to prices from one year ago, this month.

- Meaning? If you compare this month's prices to that of one year ago, a time when prices had already risen precipitously, then it's not that hard to get a lower percentage increase relative to an already high baseline.

- So, in reality: Just because the number is falling doesn't mean the prices are. If the price of eggs jumped 50% from June 2021 to June 2022 and then didn't move again between then and June 2023, the year-over-year inflation on eggs would be… 0%. Yet the price is still elevated relative to what we were used to in 2021. Long story short, inflation doesn't paint the whole picture.

- So inflation is falling, but consumers are still struggling, and the anecdotal data shows it. Consumer confidence fell from 103.7 in April to 102.3 in May, 61% of Americans now say price increases have caused them financial hardship, and consumer's perception of the labor market is deteriorating.

- The outlook: It doesn't alleviate any stress to know even that the cost to borrow money is up as a result of the Fed's fighting inflation, and that we're still expecting to average 6.1% inflation over the next 12 months.

Take this related lesson and earn 🟡 Dibs: | | | |

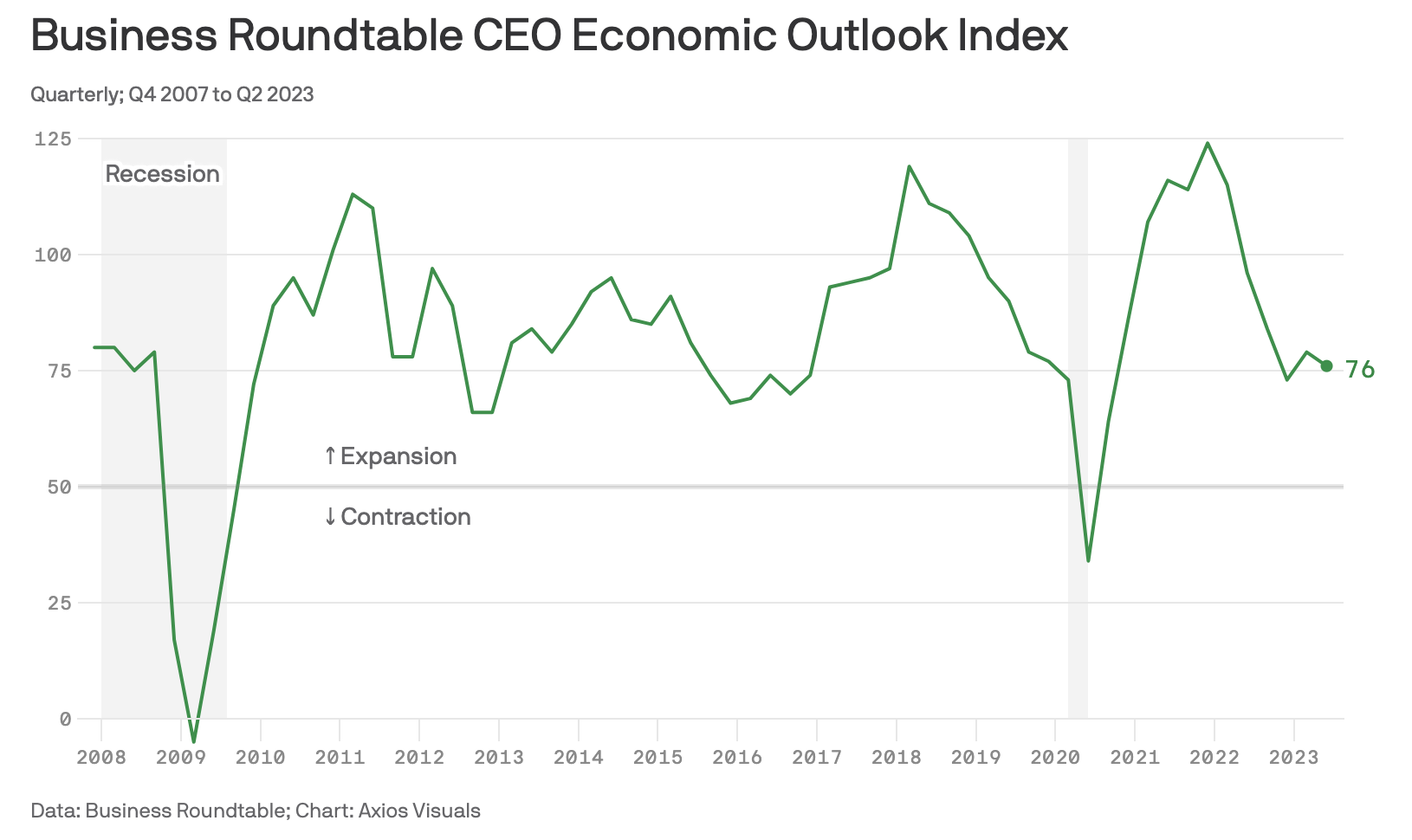

ECONOMY What About That Recession? | | | | The U.S. economy has been draped in recession fears for over a year now. We even passed the "official recession" test when GDP fell for the 2nd straight quarter in Q2 of 2022. And yet, there is no agreement that we're in one. There are enough conflicting realities to keep us from feeling like we're in the midst of a downturn though — wages are up, unemployment is down, and retail sales remain mostly strong. But despite these facts and figures, certain areas of the economy are still suffering. So what gives? The truth is we may never get a traditional recession out of this, but rather a cyclical one. Doing the math - Recipe for recession: Rescuing the economy with stimulus and basement-level borrowing costs was beneficial during the pandemic, but the whiplash has proved to be a burden. As a result, we were given some stubborn inflation to deal with, a nuisance that could only be eradicated through drastic measures.

- The rate hikes tell all: On the surface, it might seem like the Federal Reserve increasing some rates doesn't mean much, but the rippling effects of this are huge. As a result, the cost of borrowing money, and therefore doing business, rose rapidly. Subsequently, this resulted in a tightening of the economy with less financial activity all around.

- The fallout: Rates on common loan types like mortgages rose, and home prices fell alongside purchases, with sales down 23% annually as of April. Elsewhere, fewer individuals can afford loans of all kinds as banks tighten their lending standards and the cost to borrow rises. For businesses, the cost of raising and borrowing capital for growth increased too, and outstanding debts became more expensive.

- But, there's this: All of that seems to point to a potential recession, but that's only the downside. Look elsewhere, and you'll see historically low unemployment rates, consumers still having roughly $500B in nominally dubbed "excess-savings," wages are up, and the overall flip side of things simply looks, well, positive.

- Why the resilience? In theory, the Fed's contractionary policy would reduce demand for goods and services, and subsequently reduce demand for workers. But, the Fed has no control over the supply side of things. Our labor force is smaller now than it was prior to 2020, dropping from 63.3% to now 62.6%, but it's still short the equivalent of roughly 2.3M workers.

- Growth outlook: The International Monetary Fund (IMF) projects a 1.6% real GDP growth rate for the U.S. in 2023, and 1.1% in 2024 while global growth is also projected to taper. Despite the slowdown, more and more CEOs expect a "soft landing" for the economy, and fewer expect to reduce their headcounts this year.

- The takeaway is that on a macro level, economies around the world are still reeling from the past few years, but locally, most people are doing "okay enough" or better to keep us from a recession.

Take this related lesson and earn 🟡 Dibs: | | | |

CRYPTO Crypto's Recent Lawsuits | | | | Crypto has been a roller coaster over the past few years, taking passengers on a tour of both all-time highs, frightening drops, and now, extreme uncertainty. After a spree of fiascos, bankruptcies, and controversies to cap off 2022, the crypto markets have been eerily quiet for the first half of the year as investors mounted some subtle, apprehensive gains. Well, that was until this month. Now, crypto investors find themselves in the wake of yet another round of legal headwinds. What's up? - Binance is the world's largest crypto exchange and was also the parasite that kicked off FTX's demise. Now, it's under siege by the Securities Exchange Commission (SEC). The SEC is filing a total of 13 charges against the crypto giant, some of which include being an unregistered broker, misleading investors, and failing to restrict access to U.S. users.

- Coinbase, the largest crypto exchange in the U.S., couldn't avoid the crossfire either. The SEC brought similar charges against the entity, charging it with being an unregistered securities exchange, broker, and clearing agency while also hitting them for the unregistered sale of securities via its staking programs.

- Perspective: In short, these leading crypto exchanges will have to face and settle these charges, but they pose a more existential threat than just legal proceedings. It's not as simple as just "show up and get registered" — the SEC doesn't work that way. Coinbase and Binance may have to make significant changes and compromise to reach true validity in the eyes of regulators.

Take this related lesson and earn 🟡 Dibs: | | | |

🌊 BY THE WAY | - 💹 Answer: 65 months. Plainly and correctly dubbed "the long depression", the recession that began with the Panic of 1873 is the longest tenured slump our economy has endured (Statista)

- 🚀 IPOs may be coming back after a drowsy couple of years (Axios)

- 📝 ICYMI. Think twice before closing an old credit card (Finny)

- 👨💼 Gen Z and Millennial workers are tired of workplace jargon, feeling left out and confused (Yahoo Finance)

- 📊 Finny lesson of the day. In the theme of recession talk, it might help to learn a bit more about them to help understand how exactly we've avoided one thus far:

| | | |

| |

| Advisory services are offered through Origin Financial, a Registered Investment Adviser registered with the U.S. Securities and Exchange Commission. The status of registration as an Investment Adviser does not imply a certain level of skill or training. The information contained herein should in no way be construed or interpreted as a solicitation to sell or offer to sell advisory services. All content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions. Nor, is it intended to be a projection of current or future performance or indication of future results. | | | | | | | |

No comments:

Post a Comment