Happy Thursday to you all. The weather’s freezing and wreaking havoc, and our thoughts are with those struggling because of it. And today we have some investing topics that may give you an extra jolt. Before we dive into them, we wanted to share that The Gist by Finny is possible thanks to our like-minded, mission-aligned partners like Insurify, whose contributions help keep Finny's financial education free and accessible for all! So let's get right to it. Topics for today:

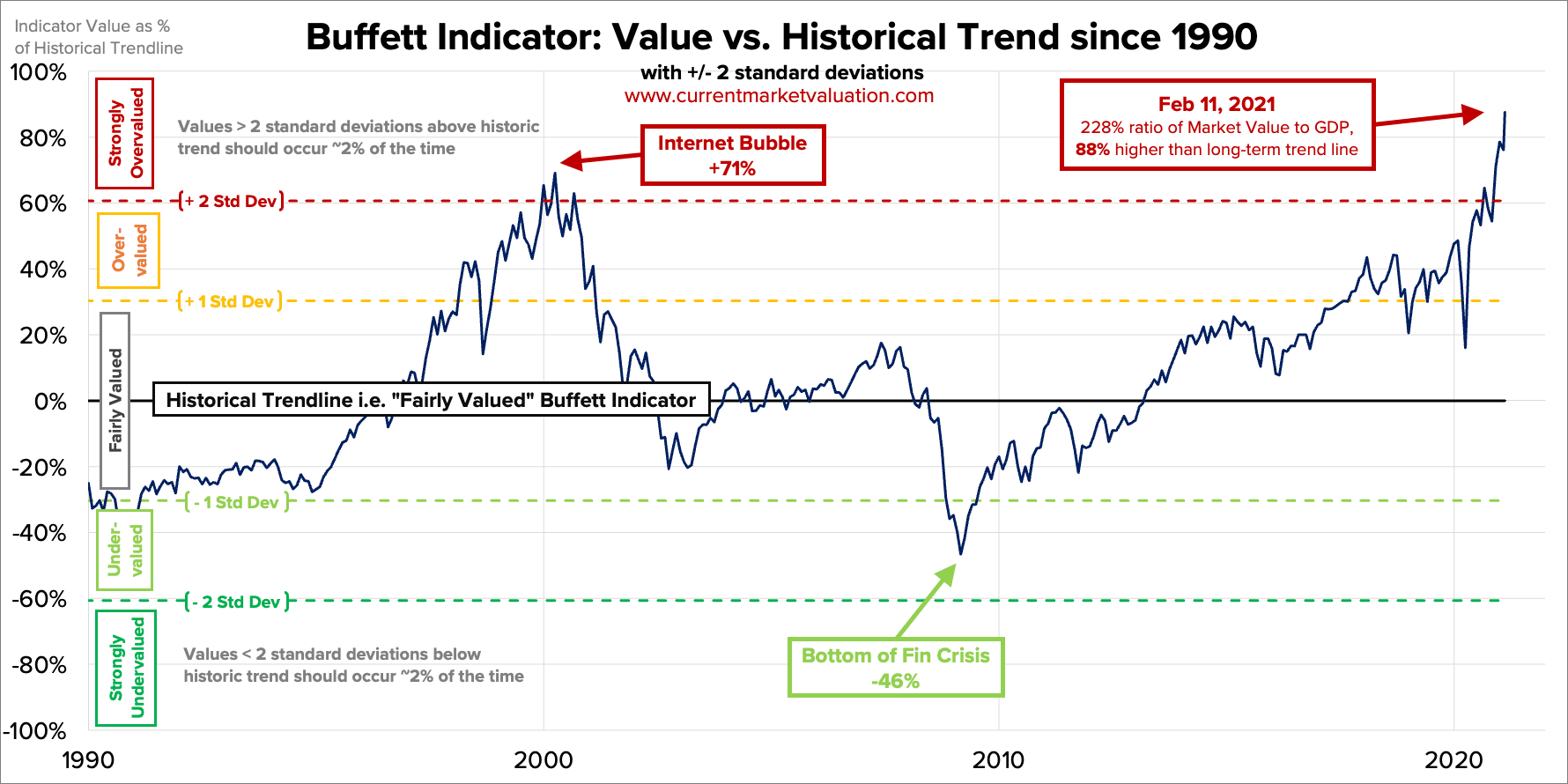

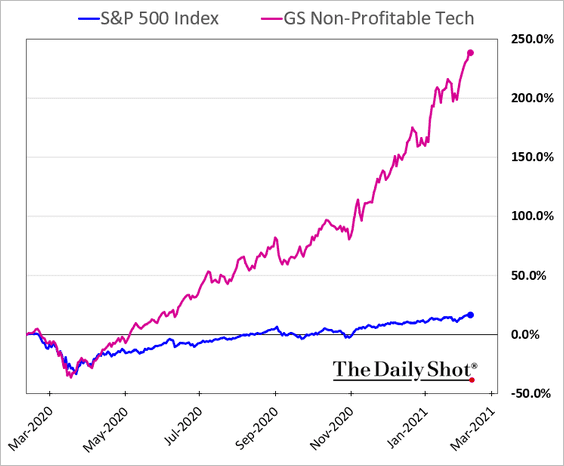

INVESTINGWhy the market is nuts right nowRemember that GameStop and AMC craze at the end of January? It was certainly fun while it lasted, but the market didn’t like it very much. The month ended with the worst performing week since October 2020. But my, how February has been a different story. This month has been the best month for stocks since the 2020 election, and broad market indexes have consistently hovered around all-time highs. But there are a lot of things to be mindful of and concerned about. Complacency As quoted by Fortune Magazine, Charles Schwab’s chief investment strategist Liz Ann Sonders said, “I continue to think the success of the market, really since early November, has also bred its greatest risk—which is just a very frothy sentiment environment... there’s a lot of complacency, if not just outright euphoria." She’s not wrong. According to a JP Morgan barometer, global investors are the least fearful they’ve been in two decades. They could also be the most greedy they’ve been in that time frame too. How does JP Morgan figure this? The investment bank took valuations, positioning, and price momentum and found that all were near their highest levels since the dot-com bubble burst. And BofA Securities Chief Investment Strategist Michael Hartnett also said that they found in its latest survey of money managers that “[The] only reason to be bearish is…there is no reason to be bearish.” Overstretched Valuations Earnings season was nothing short of a rousing success to kick off 2021. Over 80% of S&P stocks that have reported earnings have beaten estimates. What's more, earnings are estimated to rise by approximately 24% in 2021 versus the prior (Covid) year. So what? Well, only 12 years since 1980 have earnings increased by 15% or more, and in all of those years (sans 2018), the market gained an average of 12%. But do the valuations necessarily justify this? Not quite. Look at the Buffet Indicator, which takes the total US stock market valuation divided by the estimated Gross Domestic Product (GDP) as of February 11, 2021. According to this chart, the market could be 228% overvalued and 88% higher than the long-term trend line. We also have a higher Buffet Ratio than when the dot-com bubble popped. Take also the S&P 500. Its Shiller P/E or CAPE ratio (which is a “cyclically adjusted price-to-earnings ratio - basically looking at longer-term, or 10-year, earnings average) of 35.7 is among its highest valuations in history. Its forward P/E ratio is also significantly higher than its historical average. The small-cap Russell 2000 index has also never traded this high above its 200-day moving average after gaining almost 50% since the end of October. Do the math—that is a bonkers move for 3.5 months. Couple that with the fact that the tech IPO market is 'nuts.' Even the Goldman Sachs non-profitable tech index (a basket of non-profitable US-listed companies in innovative industries) tells a similar story. It’s outperformed the S&P 500 and gained almost 250%! Got gains? What do bond yields have to do with this? Bonds have seen significant momentum as of late. The 10-year Treasury yield is currently around 1.33%, its highest level since February 2020. The 30-year rate is also at about its 1-year high. If bond yields are rising, indicating that we could be getting back to normal sooner than we think, why should it be a warning sign for stocks? It's simple, really. Rising interest rates mean stocks become relatively less attractive. But for growth sectors like tech that have been loving these ultra-low rates, it’s not such a good thing. Do you know what else rising bond yields mean? Investors expect GDP to heat up for inflation to return. Inflation Rising bond yields could signal that people may want interest rates to rise sooner rather than later. While this is desirable for the cost of goods, it’s not so much for stocks. And we haven’t seen real inflation in a really, really long time. If interest rates stay too low for too long, which judging from the Fed, could be the case, we could see hikes in prices sooner than we realize by mid-year. We take our lack of historic inflation for granted. But if this loose monetary policy stays too comfortable for long, beware... What do you think? Join in on the discussion on Finny. PRESENTED BY INSURIFYHow do you know you're not leaving money on the table on car insurance?Did you know that drivers miss out on $585 per year on average by not comparing car insurance policies? If you're among the 38% of Americans who haven’t checked your price or comparison shopped in the last few years, don’t assume you’re getting a good deal. The company that was cheap two or three years ago is probably not a good deal for you now. It may be high time to start comparison shopping on your car insurance. But with over 655 different auto insurance companies in the U.S., how do you even start? We’re here to tell you there’s some good news because Insurify can help. 💰 Users can find policies as low as $15 / month for insurance. You'll never know what prices you're being offered by different carriers until you ask for a quote—Insurify does that work for you. ⏲️ It takes just 2 minutes to see quotes from 10+ carriers on Insurify's platform. Insurify is a quick and easy way to compare car insurance quotes safely. They work with 60+ insurance carriers to get you the best prices. ⚙️ They make the process easy. To get enough quotes to feel like you've truly shopped around (5-6+ quotes), you'll need to enter your info over and over on different sites. Not with Insurify. And if you're not already insured, they still got you covered. ️🛡️ No fees and no spam. It's completely free to see your quotes, your data is never sold to any third party, and there is never, ever any spam. Check if you can cut down on your car insurance bill with Insurify. Compare quotes for free. CRYPTOCURRENCIESCryptos are having their day, but beware of the risksFor the first time in its history, Bitcoin exceeded $50,000. It’s a new era in cryptocurrency. With the decline of the dollar, growth of fintech, increasingly decentralized finance, and large companies adopting cryptocurrencies (Tesla, Mastercard, Paypal, BNY Mellon, and more), it could be here to stay. Bitcoin has already gained 77% year-to-date and 433% since last February. Plus, what about Dogecoin’s rally? There’s never been a more exciting time to get into crypto. Especially if you’re into tweeting about it. This rally could be different from the 2017 Bitcoin bubble though. In 2017, when Bitcoin exceeded $20,000 for the first time mostly thanks to retail traders, it promptly lost more than 80% of its value. But now, with institutional investors getting involved, it could potentially be more stable and sustainable. But beware of the risks The first risk, of course, is the question of “whether this is a bubble or not?" Assets don’t ever just go up in a straight line. Bubbles always pop, and history repeats itself. Experian also lists these three risks to be mindful of when investing in crypto, and they make a lot of sense:

Consider this risk as well—regulation. One of the most significant issues with cryptocurrencies is how to define them as an asset class. Regulation will matter a lot for cryptos in the long-run because it will determine how the SEC and other governing bodies will treat them. It will not be the wild, wild west forever. For now, though, have fun but be cautious. Enjoy this ride while you can. And don’t invest anything you’re not comfortable losing. ✨ TRENDING ON FINNY & BEYOND

How did you like The Gist today? (Click to vote) That’s it for today. If you’ve enjoyed today’s edition, please invite your friends to join Finny. Have a great rest of the week! The Finny Team Finny is a personal finance education start-up offering free game-based personalized financial education, a supportive discussion forum, and simple stock and fund tools (aka Finnyvest). Our mission is to make learning about all things money fun and easy!The Gist is Finny's newsletter to our community members who are looking to save and make more money, protect their finances, and be their own bosses! It's sent twice a week (Tues/Thurs). The editorial team for this edition comprises Matthew Levy, CFA and Chihee Kim.Sponsors are mission-aligned partners that offer unique and valuable services at little to no cost for our users. We only feature those partners we love using ourselves. And we're thankful for their sponsorship to enable Finny to operate! Here's our advertiser disclosure.If you have any feedback for us, please send us an email to feedback@askfinny.com.If you liked this post from Finny: The Gist, why not share it? |

🌰 The market is nuts

Subscribe to:

Post Comments (Atom)

Author: Kopral Muda

No comments:

Post a Comment