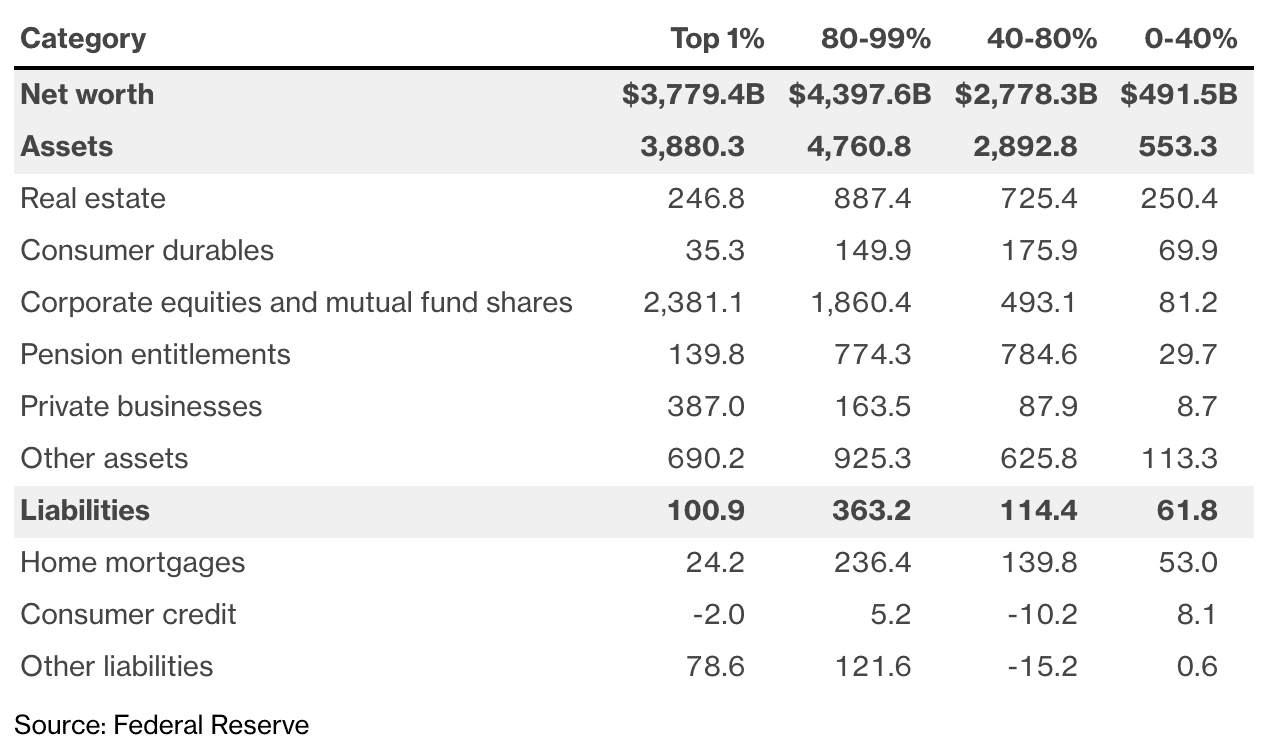

| According to a survey by the New York Federal Reserve, a record low 32.9% of participants are planning on working beyond the age of 67. And for those aged 55+, we're seeing a record 2.7 million of them planning to apply for Social Security benefits early. That's almost double the 1.4 million in the same age cohort who are planning to work longer. Americans 55 to 69 added $4.2 trillion to their assets last year—that's a $2.2 trillion increase in equities and mutual fund shares, $250 billion to the valuations of privately owned businesses, and $750 billion to real estate. A growing desire to get out of corporate life combined with the K-shaped economic recovery from 2020 has inspired many to potentially retire early, and they've now got the ammunition to do it. 2020 Shifts in Wealth of Americans

Source: Bloomberg The philosophy What good are our golden years if they don't come until the last quarter of our life? Shouldn't we do what we can to try and retire as early as possible? This is not a novel concept, but the idea has become amplified by a novel pandemic scare in 2020. The FIRE movement, or Financially Independent Retire Early ideology, has actually been around since 1992, but employees that range from Baby Boomers all the way to Gen Z are looking for the quickest way out more so than ever. People want to enjoy their life while they still can, and who could blame them? The means If you aspire to join the early retirees one day too, here are a few simple tips. - Keep a check on your allocations: Your portfolio is there to help you retire, make sure your allocations are adjusted according to your goals, and rebalance if necessary.

- Create a mock retirement budget: Spend some thought on what you'd want your ideal retirement to look like, and try to approximate a budget that corresponds to it. From there, you can make the necessary calculations and accommodations to start working towards it.

- Invest as much as you can: Most people don't get rich from their job, that's just how it is. The more of your salary you can dedicate to investing wisely and consistently, the better you set yourself up for the future you desire.

📚 New to the idea of FIRE? Learn more about it to see if it's for you: |

No comments:

Post a Comment