| It was a rather rapid turnaround, wasn't it? The S&P 500 went from having its 7th worst year on record to surpassing 19% in gains on the year, seemingly in the blink of an eye. On the surface, the waters look pretty calm right now, but some investors are worried about the risks that may lie beneath. Is there any real reason to worry though — is this bull run for real? First, the positives - The economy: The main apprehensions investors had regarding 2023's rally was the state of the economy. Inflation, rate hikes, and bank trouble had most of us on edge earlier this year, but things have proven resilient since then. Inflation has cooled to 3%, unemployment remains historically low, rate hikes are slowing, and the banking contagion seems contained.

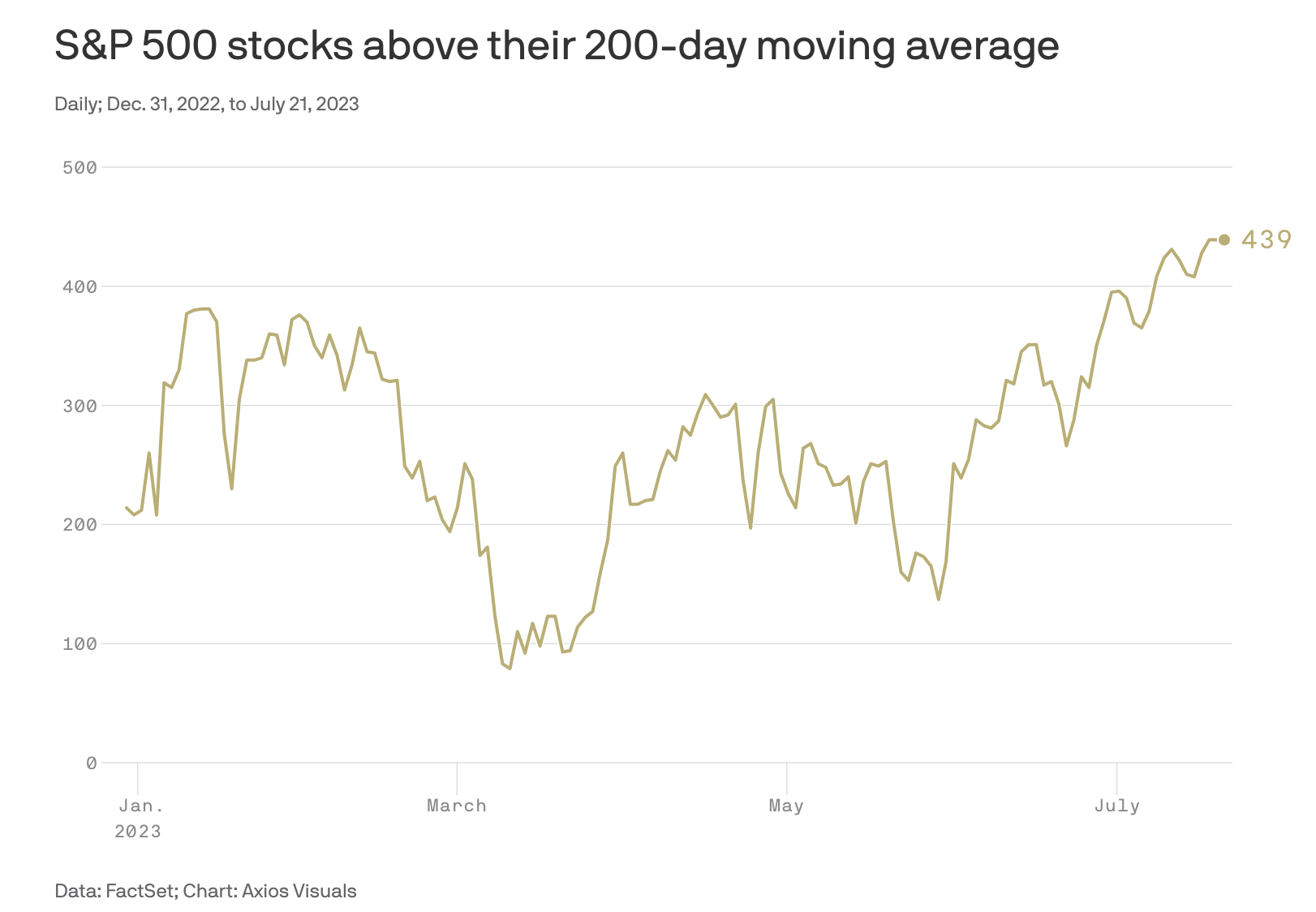

- Broadening out: The market's rally was a bit top-heavy earlier in the year, relying heavily on "magnificent 7," a tech-centric grouping. Over the last couple of months though, the rally has broadened out and started looking more sustainable as 70%+ of S&P 500 stocks sit above their 200-day moving averages.

Points of contention - Globally, almost all major indexes are lagging behind the U.S. markets. The Hong Kong Seng is narrowly in the red (-4%) for the year, the Shanghai Composite is up just 3%, and Europe's STOXX Europe 600 index has climbed about 8.5% to date. This observance begs the question: Are U.S. markets overly eager?

- The inverted yield curve has long been a supposed indicator of a pending recession and likely market downturns. Short-term rates are above long-term ones, meaning bond buyers fear more uncertainty shortly than the completely unknown 1-3 decade timeline. Are markets naive, or are the bond markets just lagging?

At the end of the day It's a classic pessimist vs. optimist situation. Some investors are still awaiting the other shoe to drop, while some have accepted that things might actually just be okay. They both make valid points, too. While it's impossible to ignore how far we've come, it's also necessary to acknowledge the looming threats that still linger. So maybe the best position we can take is a neutral one, and to keep investing for the long term no matter what. |

No comments:

Post a Comment