Hope everyone’s doing great this week. The weather’s getting nicer, and things are looking more like the old normal we knew. But as the last several weeks have shown, we’re not out of the woods yet despite the $1.9T. We'll cover some topics that may come in handy during these historic times:

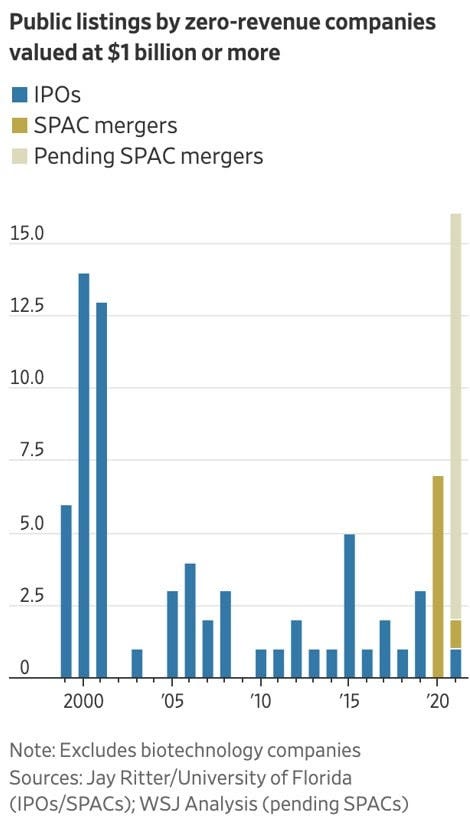

To ensure you are getting The Gist every Tuesday and Thursday, please move it to your primary folder (Gmail), or add it to your VIP (Apple Mail) or favorites (Outlook)! INVESTINGHow are companies going public with $0 revenue?Have you heard a lot about SPACs without totally understanding what exactly they are and what they do? SPAC is an acronym for “special purpose acquisition company.” These companies are also commonly known as “blank check companies.” They are publicly traded shell corporations created to acquire a private company and take it public without going through the more onerous, traditional IPO process. So how are all of those unicorn companies ($1B+ in valuation) going public with $0 revenue and surging? Thank the SPACs. So what does this mean for you as an investor? Well, for one, SPACs have entirely changed the existing model of developing early-stage startups. Young, often revenue-less companies can now go public sooner and have access to significant capital. Because of this, you, as an investor, for the first time, can act as a venture capitalist and get in on the ground floor. Since the start of last year, investors have poured more than $130 billion into SPACs chasing these opportunities. But there’s a real risk and controversy here. SPACs have genuine bubble potential. Everyone from Bill Ackman to former MLB star Alex Rodriguez has a SPAC now. Even the SEC is sounding the alarm on celebrities hyping SPACs. And if too many of them hit the market, it can create dangerous saturation of shell companies worth practically nothing. “They’re bookends of greed, wanting instant riches and getting them. As someone who has brought a company public, I can tell you that SPACs shouldn’t even be allowed,” said CNBC personality Jim Cramer. And if you think we’ve been yelling SPAC at you this whole time…don’t take it personally. Reminiscent of the dot-com bubble? You want to find the next Amazon.com, not the next Pets.com. Not all SPACs are created equal though, and if you're considering buying, we'll state the obvious: understand your risk tolerance and do your homework. SPOTLIGHT ON FINANCE START-UP, BLOOOMRetirement planning insights from Chris Costello, blooom’s CEOWe recently sat down with Chris Costello, co-founder and CEO of blooom, an online financial advisor that helps the average investor make better investment decisions and save for retirement. Blooom started in 2013 with the goal to provide expert retirement help to those previously overlooked by traditional financial advisors. Today, Blooom manages tens of thousands of retirement savings accounts, so we asked Costello about common mistakes people make while saving for retirement. 💡 There is no such thing as earning too little to start saving for retirement “I don’t make enough to save for retirement,” is the sentiment expressed by some 20-something year-olds, and unfortunately can be costly in the long run. “Human nature is to think you're going to live forever,” says Costello. “It’s not until you’re in your 30s when you get married or you’re starting a family that you start thinking about retirement. By then the balance in your 401k is getting to a level that is not insignificant. But depending on your saving habits in the early days, that balance could have missed out on some significant earnings power.” Those folks who took the retirement challenge seriously in their 20s and contributed consistently to their retirement plans are the ones who wound up with much higher account balances. It’s the early days that count the most, since interest and earnings within your account compound over time. Simply put, the longer you stay invested, the greater the opportunity for growth on top of growth. 💡 Smart and busy people are neglecting retirement savings, leading to costly outcomes “The next pattern I see is, smart people making silly retirement mistakes costing them thousands of dollars,” says Costello. “Those are people doing pretty darn well in life, having great careers, college education and smarts, but they are way too busy to worry about investing and so they wind up neglecting their money.” “And if you don't have a lot of money,” says Costello, “you're kind of forced to DIY it, which is a problem for some people.” In this bucket, you’ll find people who approach retirement planning like an arithmetic exercise. Imagine you have 15 funds in your 401k portfolio and allocate an equal amount to each of those funds. Silly you may think, but it happens more often than you could possibly imagine. 💡 Overconfidence is your enemy in retirement planning A recent study conducted by blooom shows that even among Americans with some type of retirement account, only about half are confident that they will be able to retire comfortably. And when it comes to our financial goals, overconfidence can drive poor outcomes. “It’s not that people are not capable, quite the contrary. They do their homework and educate themselves. But at the end of the day, they make choices which are not appropriate for their age, life goals and risk tolerance,” says Costello. There are some things in life you can and should DIY, like booking your own travel. But there are some things you shouldn’t DIY, or at least get a second opinion on, such as an appendectomy if you think you’ve got appendicitis. And maybe personal financial security isn't as important to you as your health. But it shouldn’t be far behind. Studies show that financial insecurity can lead to problems in other parts of our lives, including relationships, health and careers. Our take. If you’re a DIYer when it comes to investing and retirement planning, don’t have a financial advisor, or perhaps have one but want a second opinion, blooom can help you by leveraging their technology and team of human advisors. Unlike traditional advisors that charge a percentage of your account, blooom charges a low flat annual fee to then fix and manage those accounts. They are on a mission to bring badly needed affordable financial advice to a massively underserved segment of the American population today. Get a complimentary retirement account analysis. Think of it as a free check-up of your investments! Get $20 off if you sign up for blooom's paid service. Use promo code FINNNY (yes, that's 3 Ns!). INVESTINGHow to play President Biden's "America Rescue Plan" to your advantageWe have a double whammy coming that could push value, cyclical, and recovery stocks to the stratosphere—an improving vaccine rollout and President Biden’s “America Rescue Plan.” The “America Rescue Plan” is President Biden’s $1.9 trillion stimulus package set to bring aid to Americans and small businesses, and give the American economy a shot in the arm—just like Pfizer, Moderna, and J&J are doing for people around the world. Many DIY investors are asking us: how can I leverage this to my advantage? Focus on finding value in companies that were hurt the most in 2020 and could storm back in 2021. Recall our analysis from last week's “pandemic laggards turning into leaders?” Outside of your home improvement stores such as Home Depot and Lowes, which had strong 2020s, look to restaurants, travel, hospitality, and specialty retailers. But most importantly, find companies with strong balance sheets and sustainable business models. Look also towards companies and funds that could benefit from potentially rising commodity prices. Why commodities? With stimulus measures pumping money into the economy at the same time it's opening up, people will buy things. Lots of things. That could drive inflation (when people buy more, prices go up). And the biggest winner during inflationary periods tends to be… you guessed it, commodities. And think of what sectors can benefit the most from this rescue package and a reopening economy. Specific sectors will see a surge in business this spring as the pandemic continues easing. More Americans will get vaccinated, flowers are blooming, and the additional aid and unemployment benefits will hit bank accounts, bringing on an urge for spending and new experiences. 🧵 If you have some ideas or questions on this, join this discussion thread on Finny: ✨ TRENDING ON FINNY AND BEYOND

How did you like Finny's The Gist today? (Click to vote) That’s it for today. If you’ve enjoyed today’s edition, please invite your friends to join Finny. Have a great rest of the week! The Finny Team Finny is a personal finance education start-up offering free game-based personalized financial education, a supportive discussion forum, and simple stock and fund tools (aka Finnyvest). Our mission is to make learning about all things money fun and easy!The Gist is Finny's newsletter to our community members who are looking to save and make more money, protect their finances, and be their own bosses! It's sent twice a week (Tues/Thurs). The editorial team for this edition comprises Matthew Levy, CFA, and Chihee Kim.Sponsors are mission-aligned partners that offer unique and valuable services at little to no cost for our users. We only feature those partners we love using ourselves. And we're thankful for their sponsorship to enable Finny to operate! Here's our advertiser disclosure.If you have any feedback for us, please send us an email to feedback@askfinny.com.If you liked this post from Finny: The Gist, why not share it? |

❓ Going public with $0 revenue

Subscribe to:

Post Comments (Atom)

Author: Kopral Muda

No comments:

Post a Comment