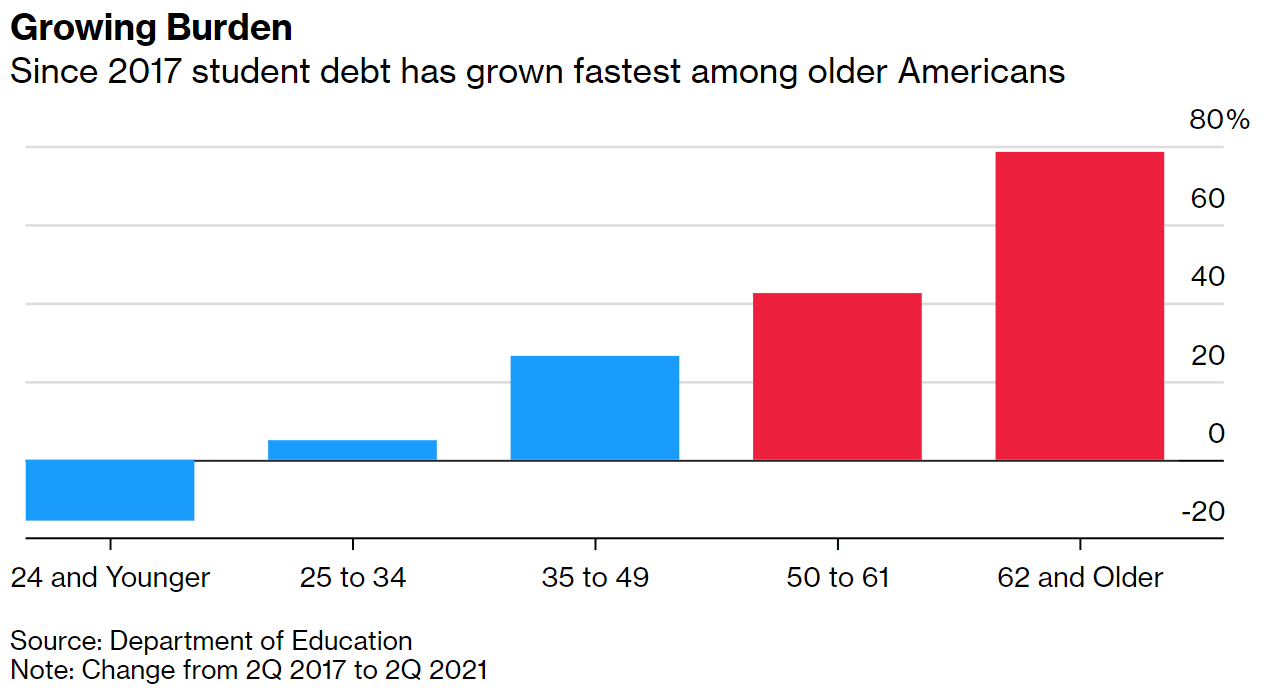

| By now, you've probably heard the remark that Millennials should stop going into debt for liberal arts degrees, or any other number of similar comments aimed at them and younger generations in regards to the student debt crisis. With the nation's total now at an overwhelming outstanding balance of over $1.7 trillion dollars, did you know that a lot of that debt is actually owned by older generations? Over the last few years, a greater percentage of student loan debt has been accruing with the older generations, with 78.6% of the growth falling in the 62+ age bracket, followed by 42.6% in the 50-61 year old range.

Image source: Bloomberg The ugly details Some of that debt is incurred by parents and grandparents who took out loans to help their children and grandchildren, but some of that balance is also denoted for those who went back to school later in life. For those who fall into the category of having taken out loans to aid their children, many of them have done so through the "Parent Plus" lending program, which is one of the most profitable government lending programs, and as some would argue, even predatory in some numbers. Parent Plus loans charge a lofty 4.22% origination fee for the first disbursement, contrasted with your classic subsidized and unsubsidized federal student loans which carry a 1.05% fee. Student loans will also be tagged with a 3.73% interest rate later this year, whereas Plus Program loans will get hit with 6.28%. The bigger picture At the end of the day, none of us would ever blame the motives of those taking out student loans in hopes of securing a better future for themselves and their family. Whether they're an older student going back to school, a parent investing in their children, or just a classical student, the rationale is honest. That's all fine and good, but good intentions can still result in a miscalculated decision sometimes, and obviously, the system we have in place could probably use a bit of work. Is it the borrower's fault, or are they just subject to the system we live in? Regardless of how you'd answer that question, it's always wise and prudent to do your due diligence and learn as much as you can before jumping feet first into a financial situation. 📚 Want to review student loan basics via a bite-sized digestible quiz? |

No comments:

Post a Comment