TOGETHER WITH  | Happy Thursday. Inflation rates have doubled in 37 of 44 advanced economies over the last 2 years. In which of the following countries did inflation grow the fastest over those past 2 years (Q1 2020 vs. Q1 2022)? a. Indonesia, b. India, c. Israel. Follow the wave 🌊 below for the answer. Here are our finance & investing topics for today: - In this bear market, dividends are still in a bull run

- A crypto market update

- How to interpret the latest inflation report

🌞 The Finny team will be taking a two-week summer break starting next week. So The Gist will resume on Tuesday, August 9th! Any questions or feedback, email us at feedback@askfinny.com.

| |

INVESTING In This Bear Market, Dividends Are Still In A Bull Run |  | | Giphy—Ferdinand Movie | | | Dividend investing is a strategy best described as not for the faint of heart, and certainly not the impatient. Investing for dividends most often means investing for income, stability, and for a long, long time. Spending money to make money - Nothin’ new: Dividends have been consistently on the rise in recent years. Save for a dip in 2020, companies in the S&P 500 notched a new dividend payout high every single year throughout the last decade. Our latest record culminated to $140.6 billion in Q2 2022, up drastically from $123.3B a year ago, and well north of pre-pandemic levels.

- Onward & upwards: Most analysts are projecting continued strong dividend growth in 2022, with some forecasting a double-digit (10%) move upwards, the first since 2014. Despite recession fears and inflation, most of these stalwart dividend companies have continued to see strong sales, and want to keep signaling that everything is grand.

- Find shelter somewhere: Despite the demoralizing market environment we’re in now, dividends have managed to remain bullish throughout, and aren’t showing any signs of slowing down as investors seek some form of income and stability. For example, compare the S&P 500’s YTD drop of about 20% to its high dividend counterpart’s (S&P 500 High Dividend Index) drop of just 8%.

Finding your own dividend style - Not for the impatient: Dividend stocks aren’t really something to get into for a short time or only during a down market—that won’t yield most investors much income at all. It’s not a strategy to produce investment income fast, or at all, unless you have a lot of cash, a lot of patience, or both. You would need to own 1,000 shares of that high-yield AT&T stock to produce $2,000 a year in dividend income. That’s a $29,000 investment, so it would take you 15 years to make your money back at present value.

- Pick wisely: It can be easy to get lured in by dividend yields that seem really high, that is until you realize there’s a reason for that. You’ll want to identify a company that strikes a balance between price stability, growth, and a strong history as a business (and dividend policies). If you don’t know where to start, look at dividend yields by sector and then drill down. You can also elect to go the route of selecting a dividend-focused fund.

- No guarantees: It’s paramount to remember that almost any stock can go sideways, especially during a market like this. While dividend stocks may be generally regarded as safer and maybe even defensive sometimes, no investment is entirely safe. As we always say, do your research (due diligence or DD) and invest only what you can afford to lose.

| | | |

MARKET OUTLOOK A Crypto Market Update | | | | The crypto markets have been through a lot in their relatively short lifespan, and have experienced their fair share of volatility and turbulence often synonymous with highly speculative markets. There are, of course, two sides to every coin. So here’s an aerial view on what’s happened and how to approach the current situation. A series of unfortunate events - Stablecoins: In the aftermath of the TerraUSD (UST) incident, the broader crypto market stayed deep red. Bitcoin correspondingly suffered a 25% drop in value over a 3-day period, and other coins followed suit out of fear. This lapse shed some light on yet another crack and potential oversight in one of crypto’s many complex underlying technical structures

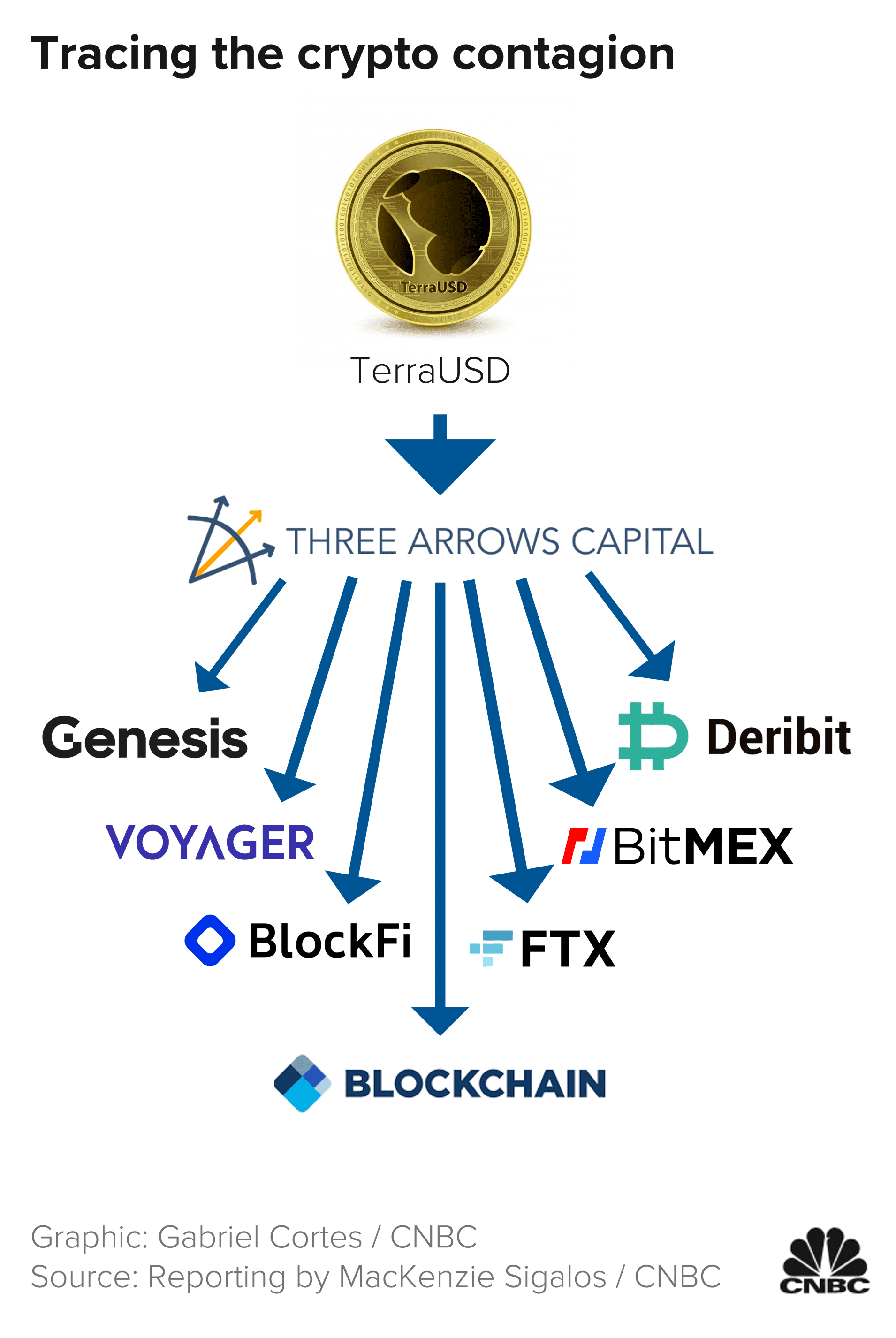

- Bankruptcy spree: Without getting into the complexities of bankruptcy legislation or what exactly led to these defaults, we’ve witnessed 3 major crypto players declare some form of bankruptcy over the last couple months. It started with 3AC (3 Arrows Capital) and their mismanagement of borrowed funds, and has since trickled within the industry to many of their creditors like BlockFi, Blockchain.com, Voyager, and other crypto firms that lent 3AC money they couldn’t repay. This chain of events has created increasing dismay and angst amongst crypto speculators, which far outweighs the die-hard hodlers, and thus resulted in more selling.

- Growing correlation: Despite being less than 1% the value of traditional stock or bond markets, Bitcoin recently touched its all-time-high 90-day correlation with the S&P at 0.58, and has clocked even higher numbers relative to more tech-oriented indices like the Nasdaq. As crypto becomes more mainstream, investors seem to be more prone to lumping it in with stocks in the traditional market too. Sounds innocent, right? Until you consider the state of our markets at present, and how a lengthy bear run in the traditional markets is going to inevitably weigh down any correlated markets too.

A few ways to look at it all - As a skeptic: Crypto has been through hell lately, and not many would blame anyone for erring on the side of pessimism here. If you feel entirely uncomfortable with crypto right now and don’t want it anywhere near your portfolio until it seems more stable, that’s a reasonable choice to make, and maybe even the right one if you’re in a situation that’s less risk-tolerant.

- As a hodler: Without nuance, news means nothing. Many close followers and true investors in the crypto community see this as nothing but growing pains, and even the CEO of Celsius (another bankruptcy participant) said he believes they’ll look back and view this as a “defining moment” for the company and crypto. If you truly know and believe in what you’re investing, then keep doing it.

- As an investor: An investor’s perspective on this situation is the objective one—one that simply asks “is there a potential likelihood of profit to be made here?” and decides based on that alone. If you’re inclined to think that the winds of trends will blow enough in crypto’s favor to turn a profit from these lows, go ahead and invest in the coin you think has the most upside. If not? Stay the heck out of it.

Take this related lesson on this topic and earn Dibs 🟡 while you're at it:

| | | |

SPONSORED BY ATHLETIC GREENS Foundational Nutrition In One Tasty Beverage | | | | Let’s face it, nobody has the perfect diet—there are just too many gaps to fill. But here’s a nutritional revelation that we just discovered and love ourselves: AG1 by Athletic Greens. - AG1 is full of vitamin C, zinc citrate, ashwagandha, and 72 other vitamins, minerals, probiotics, and whole-food-sourced ingredients.

- All you need is just one scoop daily to support your immunity, gut health, energy, and healthy aging.

- Basically, it’s an all-in-one nutritional powder that makes getting your nutrients more convenient than ever before. Oh, and it’s really tasty.

Hundreds of thousands of people already use AG1 daily to take ownership of their health. Try AG1 today and get a FREE 1-year supply of immune-supporting Vitamin D AND 5 FREE travel packs with your first purchase. | | | |

ECONOMY How To Interpret The Latest Inflation Report | | | | If it seems like we’ve been speculating on the nature of inflation for years now, it’s because we have. The Fed first started using the transitory descriptor early in 2021, and that’s since gone far out the window. The reports keep rolling in, and the numbers keep climbing. Our latest update came last Wednesday, and CPI data showed us a 1.3% increase in June alone, and 9.1% over the last year, 0.3% above most forecasts. Energy of course dominated, up 41.6% in isolation, as “items less food + energy” number came in at a much lower 5.9%. What do we make of this continual upward trend? A few things... - Energy weighs a lot: Energy makes up the 4th heaviest weight in the CPI at 7.54%, coming in behind shelter, food, and transportation. With it also being the costliest sector, the energy sector exerts a lot of mathematical pressure on our calculations, and contributes a lot to the increases we keep seeing. The good news? Commodity prices are starting to slip a little.

- A couple of key drops: Instead of just reading 9.1%, it helps to go line by line and see what items actually moved. When doing so, you’ll notice that two key categories fell for the first time in a while. A subcategory of food, “meats, poultry, fish, and eggs” dropped 0.4% after rising 1.1% last month, and “fuel oil”, another term for distilled crude, fell 1.2% after rising a whopping 16.9% last month.

- Food and energy are big culprits: If we drill down specifically on the “all items less food and energy” section, you’ll notice that no item rose over 2% in June, and most are only up single digits in the last year. Compare this with the food and energy sections where most categories are up double digits, with a couple in the energy section even nearing triples.

Take this related lesson on this topic and earn Dibs 🟡 while you're at it:

| | | |

🔥 TODAY'S MOVERS & SHAKERS | - 1life Healthcare Inc (+69%), the US-based primary healthcare clinics chain (under the One Medical brand), will be acquired by Amazon for $18 a share in cash or about $3.9 billion including debt.

- Tesla (+8.4%) shares are up after reporting better than expected Q2 earnings in Q2 but shrinking profit margin as a result of higher costs and supply chain issues; Tesla also revealed that it sold 75% of its Bitcoin holdings, adding $936 million in cash to its balance sheet.

- Carnival (-11.1%), the international cruise line company, as it announced that it will sell a billion dollars in stock with the intention to user the proceeds for "general corporate purposes, which could include addressing 2023 debt maturities."

- Bitcoin (-2.5%) to $22,645 (1D)

- Ethereum (-0.7%) to $1,511.10 (1D)

This commentary is as of 9:00 am PDT. | | | |

🌊 BY THE WAY | - 🎈 Answer: c) Israel. The inflation rate in Israel in Q1 2022 was about 25x the rate in Q1 2020; in Indonesia, inflation fell early in the pandemic and has remained at low levels; inflation in India also remain at low levels (World Economic Forum)

- 🥷 How Wall Street evaded the crypto meltown (NYTimes)

- 🎩 ICYMI. The money illusion trap (Finny)

- 🟥 Speaking of bull runs... after a pandemic Hiatus, the bulls are running again in Pamplona (NY Times)

- Finny lesson of the day. For those who are beyond crypto basics and curious about how some crypto companies were able to offer high yields, learn more about DeFi yields are:

| | | |

What did you think of Finny's The Gist today? (Click to vote) | | | |

| Finny is a financial education platform on a mission to make your money work for you. We offer a customized financial learning platform through bite-size, jargon-free lessons, money trends & insights. The Gist is Finny's twice-a-week (Tues & Thurs) newsletter covering personal finance & investing insights and money trends. Finny does not offer investment and stock advice or endorsements. The Gist content team: Austin Payne, Chihee Kim. We're thankful for the support of today's sponsor & partner—Athletic Greens—as they make rewards on our platform possible. If you're interested in sponsoring The Gist, please reach out to us. And if you have any feedback for us, please contact us. | | | | | | | |

No comments:

Post a Comment