TOGETHER WITH  | Good day. Can you guess what the average 401(k) balance at Fidelity was at the end of 2022? a. $63,900, b. $83,900, c. $103,900. Follow the wave 🌊 below for the answer. Today's finance & investing topics are: - What's bond laddering?

- 401(k) checkup: do this, not that

- U.S. student loan forgiveness update

| |

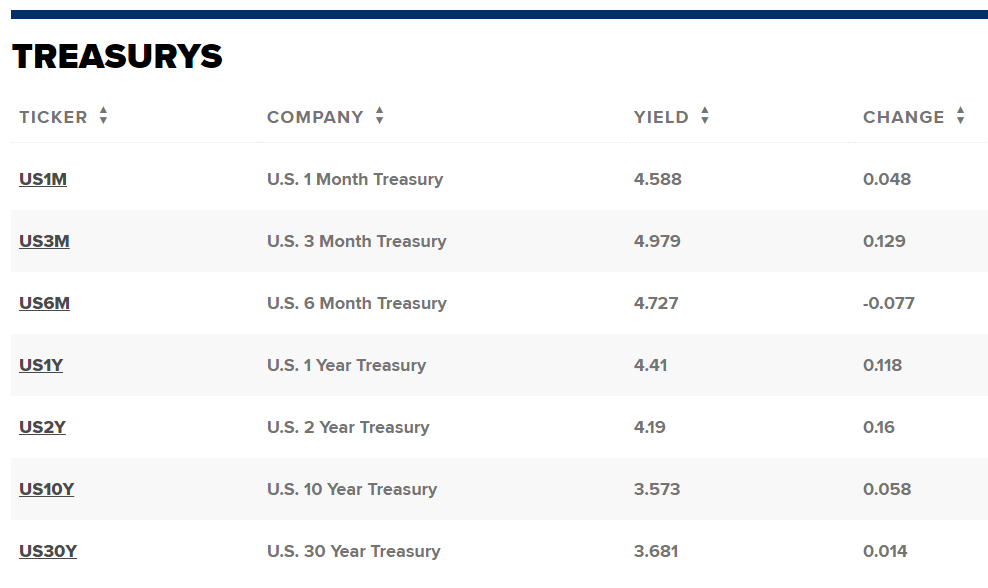

INVESTING What's Bond Laddering? | | | | For more than a decade, new bond yields have been low enough to relegate them to the closet. Over the last year though, the winds have shifted. Massive rate hikes in 2022 eroded the value of backdated bonds and gave way to big spikes in bond yields across the board, and it subsequently made bonds interesting again. Playing by the new bond rules - A conundrum: With higher yields comes a new problem — FOMO. Sure, you could lock in a historically great yield right now, but you'd also risk missing out on potentially higher yields as soon as the Fed Funds Rate moves north. And since bond yields and price are inversely related, you'd also risk the value of your bonds declining.

- What's a solution? Bond laddering. Bond laddering is exactly what it sounds like — buying bonds with different maturity dates in one portfolio.

- How it works: To build a proper bond ladder, you'll need to determine the amount of cash you have to invest in bonds, the number of months or years you'd want to invest, and how much you'd want to earn for investing in them. For example, if you have $10,000 to invest in bonds and you'd like them to span through 2024, you could stagger your bond holdings ranging from something as short as a 1-month Treasury to as long as a 2, 10, or 30-year Treasury. And the arrival of their maturity date comes with two options — collect your interest and par value, or allow your broker to auto-roll your proceeds into a new, similar bond.

- Considerations: It goes without saying that there are many variations to this. The number of rungs in your bond ladder is up to you, and this will be determined by how spaced out the maturity dates of your holdings are. Additionally, what you construct your ladder out of is also a customizable feature of bond laddering. This strategy isn't just limited to government bonds as you could also elect to include CDs, muni bonds, corporate bonds, or even junk bonds.

- Current environment: In normal times, longer-dated bonds would carry a higher yield than their shorter counterparts, but this isn't the case today. We're currently seeing an inverted yield curve, meaning short-term bonds carry a higher yield as investors anticipate interest rates to come down over the long run. Because of this reality, bond laddering is now allowing investors to take advantage of higher short-term yields.

Source: CNBC, as of 3/13/2023 Take this related lesson on this topic and earn Dibs 🟡 while you're at it: | | | |

MONEY TIP 401(k) Checkup: Do This, Not That | | | | Thanks to The Secure Act 2.0, a 2022 update brought the "lifetime income illustrations" to your quarterly work-sponsored retirement account statements, meaning account holders who weren't up to date on their holdings were shown a glimpse into their future – for better or worse. With at least 31% of Americans planning to reduce their contributions during this year's chaos, it's clear something is up, and account holders are feeling wary. So, what should they do? Tips for your 401(k) maintenance - Don't panic: Feeling fearful about the future is a natural inclination when waters are choppy as they have been for some time now, but it's paramount that we don't let this cause us to make any irrational moves. If you're investing for more than a decade away, the wisest thing to do is to invest as if nothing has changed. Investors with a long time horizon can withstand short-term volatility in the markets.

- Set your goals: The decisions we make with our retirement, and ultimately our future, should always be goal-driven. Aside from your personal objectives, the time horizon of your investment is the most important thing here, and will heavily influence how you invest. Account holders with a longer time horizon can withstand more volatility along with the higher upside that comes with higher equity allocations, whereas those aiming to retire soon can consider dialing back on their risk.

- Keep investing: It's tempting to slow down or even stop your retirement contributions when the market seems to be constantly down, and many investors have mistakenly done just that. Although it seems plausible, stopping your contributions can do more harm than good. Not only will long-term investors miss out on potential gains, but even those retiring in the near term would miss out on lowering their tax bills by failing to max out their contributions.

- Check routinely: Most of us probably aren't in the habit of checking our retirement accounts daily, and that can be a good thing in volatile times like these. Regardless, it is still important to keep a regular check on your work-sponsored retirement plan. Your new quarterly account statements are a good starting point, but add in some extra check-ins and look for room to improve.

- But, adjust at your own risk: It's extremely tempting to make adjustments to your 401(k) holdings during tumultuous times and market uncertainty, but this can also lead to a never-ending guessing game if not kept in check.

Take this related lesson on this topic and earn Dibs 🟡 while you're at it: | | | |

BUDGETING & SAVING U.S. Student Loan Forgiveness Update | | | | Death, taxes, and the bureaucracy of democracy ensure that most aspirational government policy decisions take a lifetime. Joe Biden announced plans to forgive up to $20,000 of student debt per borrower last August, and now almost 7 months later, the proposal still finds itself in the throes of a heated gridlock. After federal courts blocked the initiative last fall, the Biden administration recently appealed two of their challenges to the Supreme Court, which held oral arguments a couple of weeks ago. So, what's happening now? - Not looking good: Based on Biden's most recent comments on the matter, it looks like the administration is viewing this as a classic case of... good intentions and bad outcomes. Speaking about the most recent Supreme Court hearing, Biden said "I'm confident we're on the right side of the law," but "I'm not confident about the outcome of the decision yet." The Supreme Court holds a 6-3 conservative majority on the matter and is expected to make a final decision around June.

- No backup plan: If this falls through, there's no backup plan to forgive any student debt at the moment. For now, the Department of Education has thrown borrowers another temporary bone — a continued pause on interest payments through the end of August.

- Prepare for the worst: On the borrower side of things, ignoring the noise and assuming the worst is a solid approach to this holdup. While it would be a welcome bonus for many if the plan were to come to fruition, the reality is that we can't depend on that financial windfall.

Take this related lesson on this topic and earn Dibs 🟡 while you're at it: | | | |

🌊 BY THE WAY | - 🌴 Answer: The average 401(k) balance in Fidelity-administered plans, meanwhile, rose 7% from the third quarter to $103,900 (CNN)

- 🪦 RIP SVB. Who is next? (Embrace the Chaos)

- 🖼️ Learn to invest in fine art. The Gist readers are invited to join the exclusive community investing in blue-chip art (Masterworks)

- 🧳 ICYMI. Spring break is right around the corner. Do you need travel insurance? (Finny)

- 🍪 Why it's so hard to get Girl Scout cookies this year (Eater)

- ✨ Finny lesson of the day. 401(k): Withdraw, Borrow, or Not? While 401(k) balance rose quarter-over-quarter, outstanding 401(k) loans by participants stayed flat at 16.7%.

| | | |

| |

| Finny is a financial wellness platform. The Gist is Finny's twice-a-week (Tues & Thurs) newsletter covering personal finance, market trends and investing insights. Finny does not offer investment and stock advice. Please support our corporate sponsor — Masterworks — as they make rewards on our platform possible! If your company is interested in sponsoring The Gist, please reach out to us. And if you have any feedback about this edition or anything else, please email us. | | | | | | | |

No comments:

Post a Comment